Countries across the world especially India have envisioned digitalization across all its sectors including the BFSI sector. Accomplishing this mission would involve a series of transformations especially in the banking sector. However, in the last decade, the BFSI sector has taken long strides towards digitization. Online banking started the chain of banking transformations and was soon followed by mobile banking, digital wallets, UPI apps. Though Online banking paved way for digitization, it failed to become as popular as mobile banking due to non -friendly payment experiences.

Picture Courtesy: Google

Growth of mobile banking

Picture Courtesy: Google

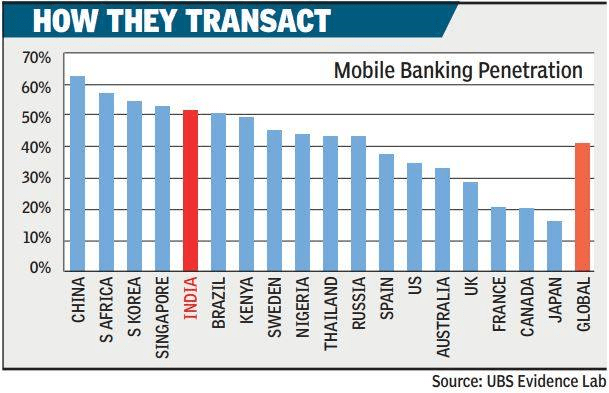

The world- wide mobile banking penetration and apps launched figures have been moving upwards year on year. The above statistics are a clear indication of mobile banking’s popularity in the last decade. With startups entering the fintech arena, digital wallets soon followed mobile banking. Digital wallets being user-friendly and easy to use, customers have taken a liking to it in a short period.

Digital wallets Picture Courtesy: Google

Though wallets are a popular choice when compared to the traditional lengthier forms of banking, they have a few painstaking activities associated with it. Some of the activities are :-

- Setting up a wallet

- Providing account details such as IFSC, Card No, CVV no, Account no for carrying out transaction

- Transferring of amount from an account to the wallet

- KYC validation for set cap of Rs 10000-1lakhs

Now to overcome these barriers and make mobile banking hassle free and more secured UPI was launched by the NPCI in India. UPI is a payment platform that allows instant money transfer without providing account details.

UPI

Picture Courtesy: readaddict.com

With the likes of UPI making an appearance in the payments space, mobile wallets usage has taken a dip. However, in my view, the implementation of the below factors could still boost wallet usage post -UPI launch.

- Providing an optional provision to link wallets to a bank account.

- Excluding few of redundant steps before transacting. For eg instead of making KYC validation must make it mandatory to provide the Aadhar no KYC validation would be taken care of.

- Wallets being a tool, currently, it is not mandatory for them to provide interest on the money transferred however if wallet companies provide interest it would improve user stickiness.

- Presently wallets users mostly rely on the phone lock for their security. Also, as per RBI rules, wallet transactions require only one-factor authentication. Only some wallets provide two-factor authentication and hence security is a matter of concern when there is a loss or theft of the phone. However, if two-factor or multifactor authentication is made mandatory wallet can be made more secure and user shift can be decreased.

- Making inter wallet transactions, regulating explicit inter wallet transactions, inter wallet usage of the generated QR codes feasible.

- Increasing the per transaction limit as currently wallets per transaction limit is Rs5000.

- Providing facilities such as reminders for collecting cash and making payment, checking account balance where account has been linked, transfer of cashback to account.

- Scrapping of the service charge of 1-4% currently being applied for a wallet to bank transfer.

- Conversion of wallet companies to payment banks which would be UPI enabled like Paytm.

- Moving towards UPI system and interconnection of wallets using National Financial Switch (as in the case of present- day Indian Banking context )

The financial sector has moved from online banking to wallets to UPI. Wallets are a stop gap arrangement till India achieves complete digitalization. Being a better way to access accounts, UPI has no doubt become “go to app” within the short period after its launch but however, wallets score some points in below aspects.

- When it comes to unbanked and the rural people not using bank accounts. Wallets being a tool wallet users as well as a third party can top it up. This is a big advantage for the students and the poor who do not have a bank account.

- Where technological costs are lower. For eg, the technological costs are lower while doing grants and donations transactions through wallets rather than doing over a banking infra.

- Where companies giving loans or micro loans can dispense this money into their stand alone wallets for the gains on float within their own bank accounts for eg Manapurram dispensing loans to MAkash wallet.

With or without the desirable features being implemented (few of them depending on RBI) Wallets will continue to be in India’s financial arena and contribute to the financial inclusion. As in the case of Teknospire’s MAkash. Having helped Valapad village to become an e-wallet-literate village, it has become a source of inspiration to other wallets and represents the existence of stand alone wallet post-UPI launch.

References:

Mobile wallets beware, UPI is here

Is there a similar system in the world such as Unified Payment Interface launched in India?

Can we transfer the cash back earned in a Paytm wallet back to a bank?

Which wallets do not charge for wallet to bank transfer?

The Cyber-frauds: How secure are Aadhar, UPI, mobile wallets?

11 Benefits of UPI | How UPI is Better Method of Fund Transfer !

How safe are your mobile wallets?

How is BHIM app different from mobile wallets?

Going cashless after demonetisation? Compare eWallets and UPI apps for what suits you best

BHIM app vs Paytm: Which is a better payment app?

How different is the Unified Payment Interface(UPI) from mobile wallets?

Post Views - 157