Blogs

What kind of AI Implementation do we find in FinStream?

For the modern CFO, liquidity is often trapped behind manual processes. FinStream replaces fragmented banking portals with an AI-native core that unifies global accounts into one intelligent dashboard. What specific problems....

Read MoreHow do AI-Powered Reconciliation Platforms Transform MEA Enterprises?

In the high-velocity markets of the Middle East and Africa, transaction volume is not just a sign of success but also a test of infrastructure. The adoption....

Read MoreHow Automated Reconciliation Enhances Financial Accuracy

In the fast-paced markets of Dubai, Riyadh, and Nairobi, speed is a competitive advantage. However, it needs to be backed by precision. For many MEA finance leaders,....

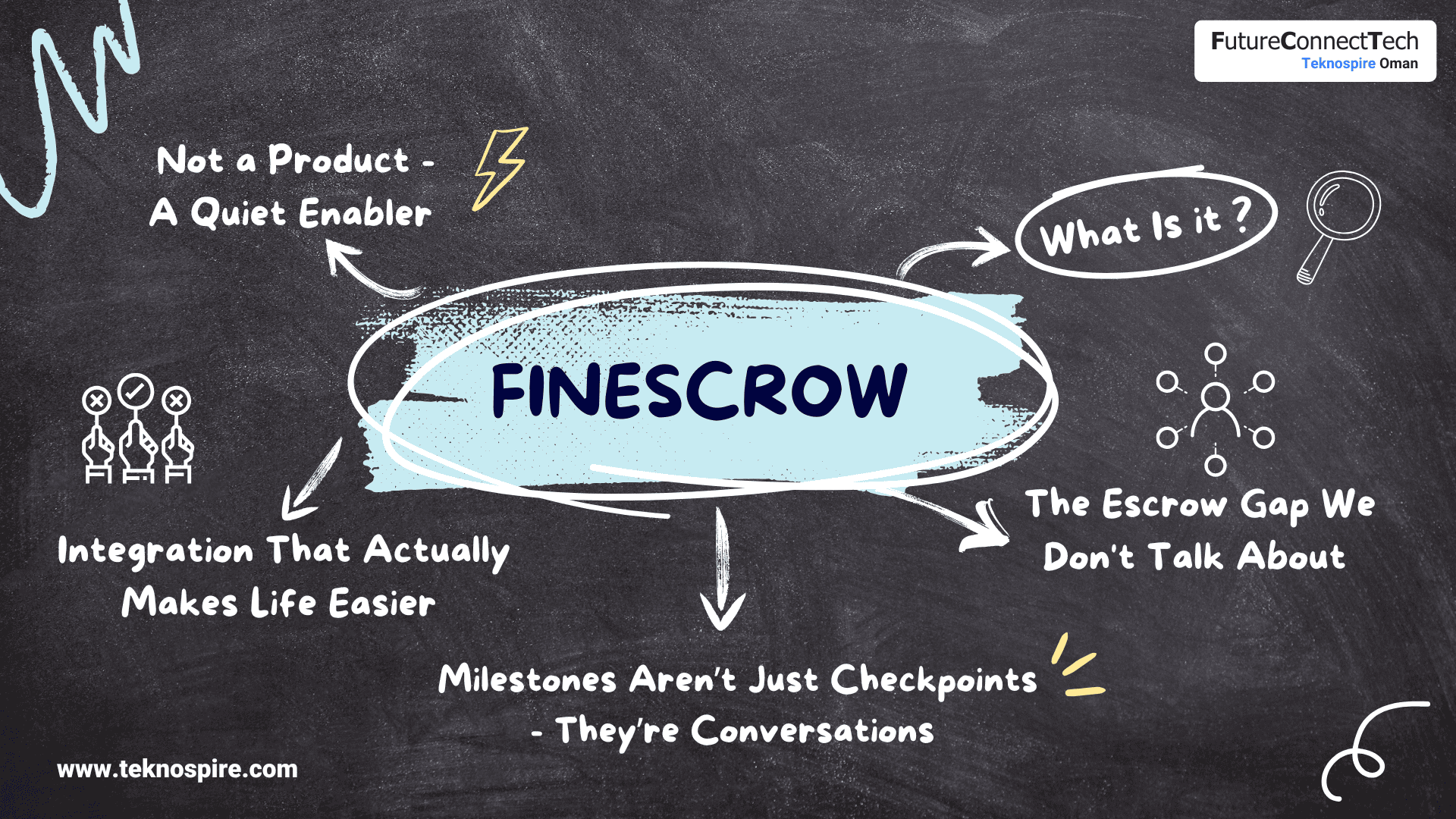

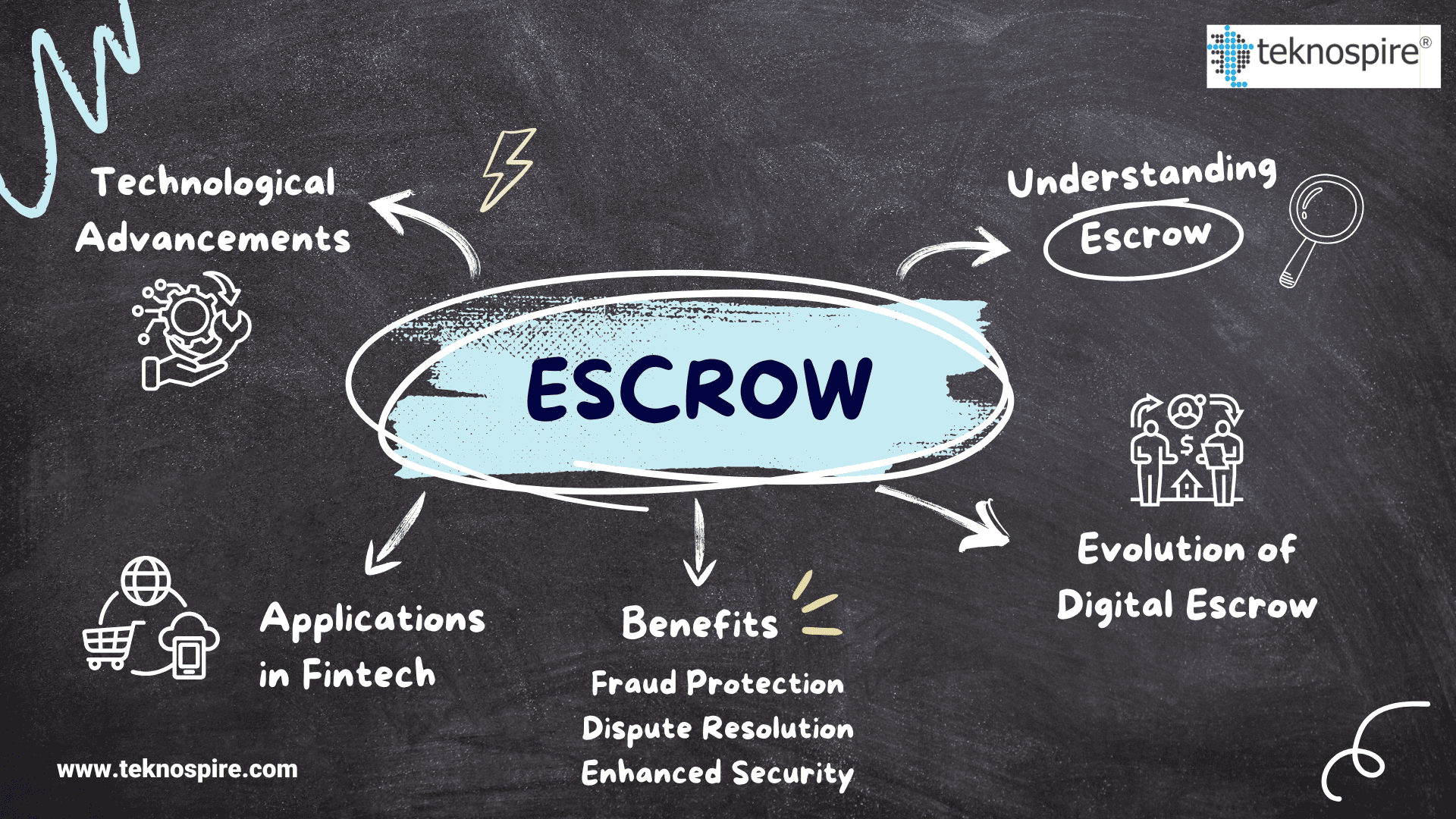

Read MoreGuide to Digital Escrow in the GCC: Securing Real Estate & High-Value Trade

In the high-stakes world of GCC real estate and cross-border trade, trust is the primary currency of exchange. As Saudi Arabia and the UAE witness a surge....

Read MoreHow Saudi Conglomerates use FinStream for Real-time Liquidity?

With the rapid evolution of the financial landscape in the Kingdom of Saudi Arabia (KSA), liquidity management has now become a front-line strategic advantage. As Saudi Vision....

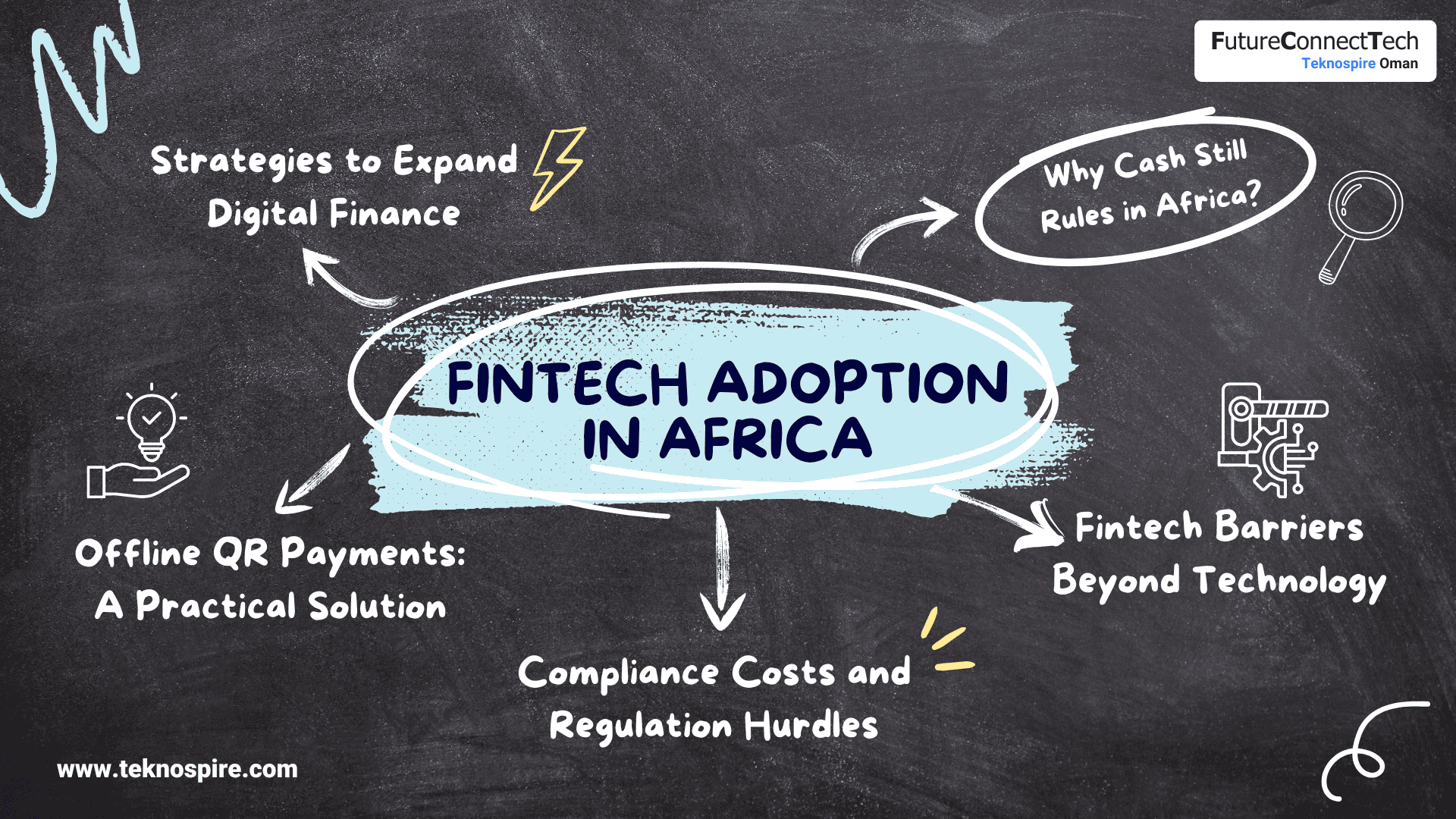

Read MoreWhat is Slowing Down Fintech Adoption in Africa and How Offline Payments Can Help?

Fintech adoption in Africa shows a striking contrast. In countries such as Kenya, Nigeria, and South Africa, digital payments and mobile financial services are widely used in cities....

Read MoreHow FinRecon’s AI Implementation Solves MEA’s Reconciliation Hurdles

Across the Middle East and Africa, the financial landscape is undergoing a rapid transformation. From the swift digitisation of the Sultanate of Oman under Vision 2040 to....

Read MoreBest Performing Blogs in 2025

2025 was a year of strong conversations around finance, treasury, and digital transformation.From practical reconciliation challenges to forward-looking fintech insights, these blogs stood out for one simple....

Read MoreCross-Border Payments in MEA: Trends, Challenges, and Solutions for 2025-2026

Cross-border payments involve transferring funds between entities in different countries, often via banks or fintech networks. In the Middle East and Africa (MEA), they support trade, remittances,....

Read MorePayment Integration Failures in MENA: Currency and AML Issues Driving High Failure Rates – and How Middleware Can Help?

What if a significant portion of your payment integrations failed due to technical glitches in currency handling or AML compliance? In the fast-growing MENA fintech landscape, these challenges cause many....

Read MoreUnderstanding Escrow Account – How it works? Uses & Benefits

In every high-value transaction, risk is inherent, whether it is an acquisition, a cross-border payment, a real estate development funding or securing a large software license agreement.....

Read MoreA guide to Physical cash pooling by FinStream’s TSA | Solutions, Benefits, How it works?

Physical cash pooling is the act of consolidating a company’s various bank accounts into a single “pool” or header account. The process consolidates scattered cash into a....

Read MoreGain 70% Faster Financial Close with Automated Reconciliation Platform

Is your monthly financial close a predictable sprint or a stressful marathon? For those in B2B sectors like travel, retail or manufacturing, the finance and accounts team....

Read MoreThe Role of Escrow Account in High-Value Transactions

High-value transactions are inherently risky. The stakes are immense, and the potential for fraud, non-performance, or simple disputes can derail months of negotiation. From large-scale mergers and....

Read MoreFinStream: A Guide to Liquidity Management

Liquidity management is the process of optimising a company’s cash position. It involves tracking, forecasting, and managing the movement of cash throughout an organisation to ensure funds....

Read MoreHow Real-Time Reconciliation is Driving Financial Clarity Across Sectors

To begin with, we can say that the term ‘reconciliation’ is now a common practice for all businesses, regardless of size. Every industry is involved in reconciling....

Read MoreAI, GenAI & Personalized Communication in Financial Services: What’s Changing

Personalization in finance has always been a buzzword. Banks and fintechs have wanted to “know the customer” better, but most efforts ended up being generic emails or....

Read MoreWhy does Real Estate need Escrow Account Services?

Let’s imagine a real estate ecosystem where funds are never lost, milestones are never disputed, and every party involved – buyers, developers, and banks—operates with complete confidence....

Read MoreWhy Modern CFOs and Treasury Teams Need FinStream?

CFOs and their treasury teams are responsible for managing cash, controlling expenditures, and ensuring regulatory compliance. Known as ‘guardians’ of an organisation’s finances, we often find them....

Read MoreFinRecon: Smarter and Faster Account Reconciliation

Imagine a finance team that isn’t drowning in spreadsheets and manual reconciliation at the end of every month. Instead, they operate with a clear, real-time view of....

Read MoreAI‑Powered Auto‑Reconciliation for Corporates

Finance teams are the backbone of every organization, ensuring smooth cashflow and accurate financial records. Yet behind the scenes, much of their time is often consumed by....

Read MoreCFOs Convert Idle Cash to Strategic Capital with FinStream’s TSA

Strategic Capital is a major concern for all CFOs. It refers to a company’s cash that is actively managed, fully visible, and intentionally deployed to support core....

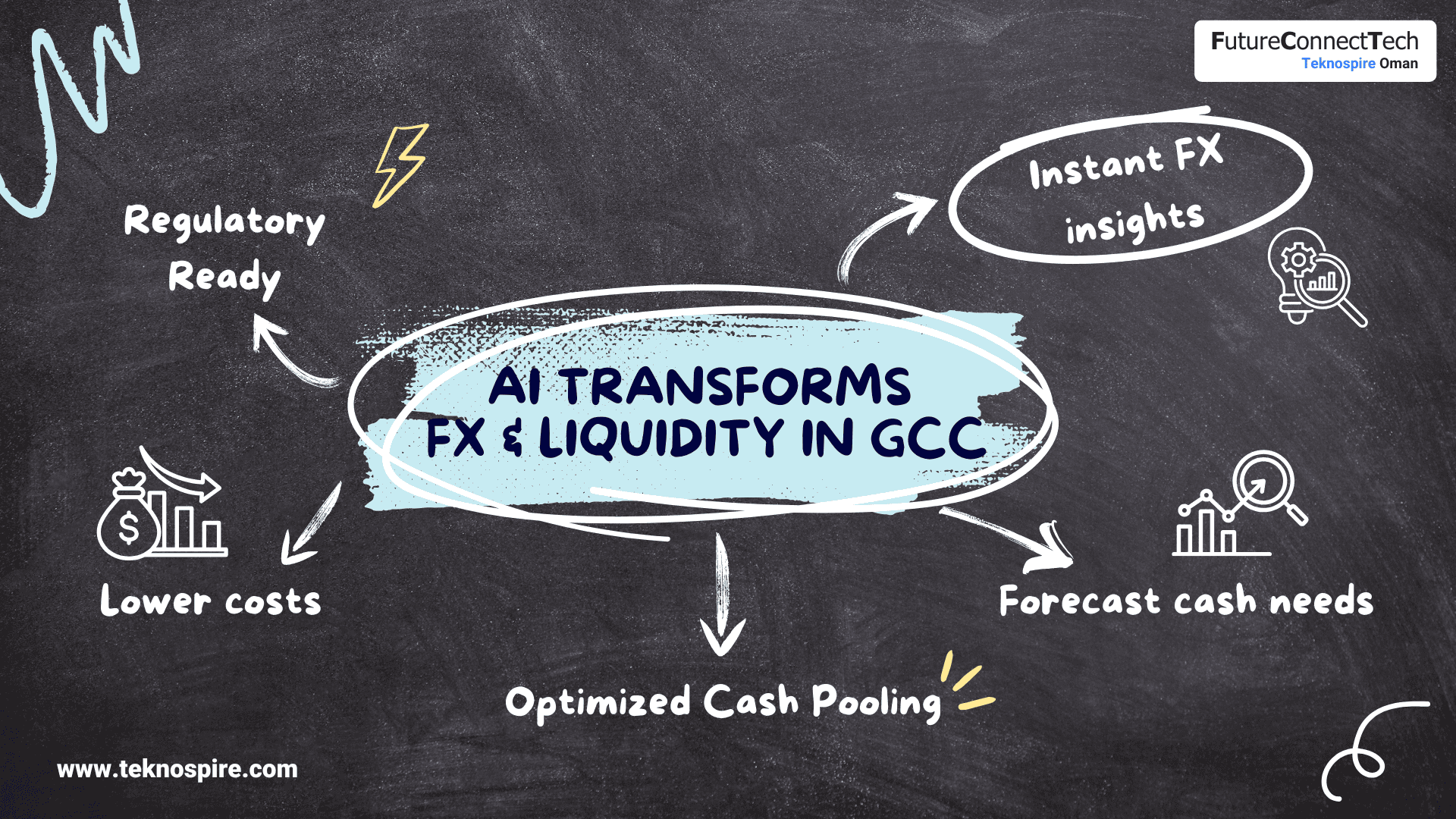

Read MoreHow AI Is Helping GCC Treasury Teams Manage FX and Liquidity in Real Time

As financial institutions across the Gulf Cooperation Council (GCC) continue their digital journey, many are turning to AI to manage foreign exchange (FX) and liquidity management more....

Read MoreEquipping Finance and Accounts Teams with Reconciliation Transformation

Finance and Accounts teams have been accustomed to manual reconciliation for decades, where struggling with human errors, disputes, discrepancies, and compliance risks is a common observation. But....

Read MoreEscrow Account: Understanding Roles & Functionalities

An escrow account behaves as a neutral third-party holding money or funds until specific, predefined conditions are met. It serves as a vital safeguard for high-value transactions....

Read MoreAutomate your Treasury with FinStream

Today, technology is everywhere, from your bedroom to your office workspace. So, why not in treasury management? Advanced technology and automated systems have enabled finance teams to....

Read MoreHow FinRecon Solves Collections Teams’ Collection Reconciliation Headaches

The collections team in any organisation is tirelessly working to secure payments and maintain financial health, ensuring a smooth cash flow. But what about collection reconciliation? Isn’t....

Read MoreWhat is An Escrow Account and What is the Purpose of It?

An escrow account is a temporary, secure account maintained by a bank that holds money and funds as a neutral third party until specific conditions are met....

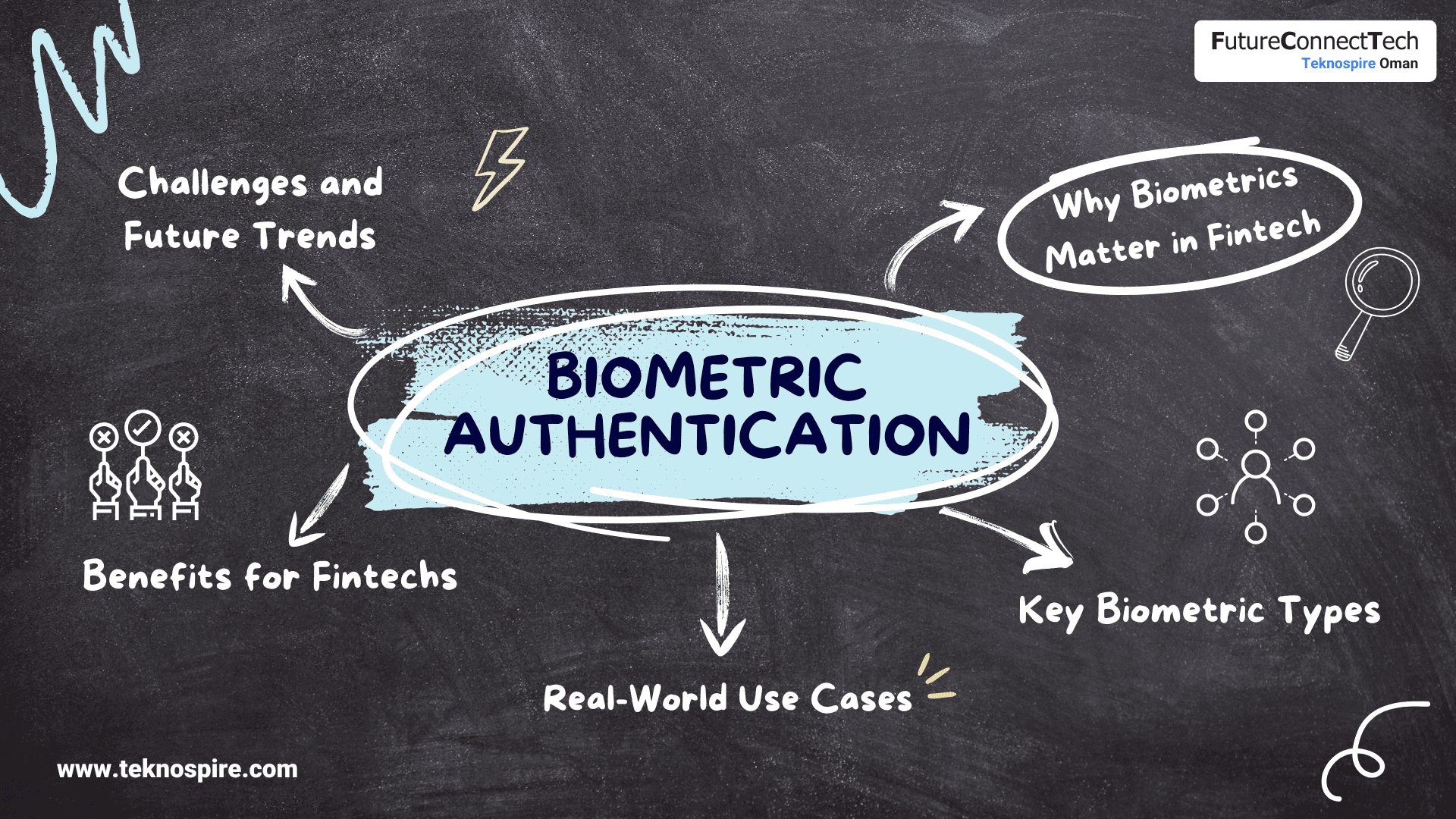

Read MoreBiometric Authentication: Enhancing Security in Fintech

In today’s fast-paced world, digital financial services are exploding from mobile banking to AI-powered investment platforms. But with convenience comes risk: fraud, data breaches, account takeovers. That’s....

Read MoreTreasury Management: Simplifying Conglomerate Multi-Entity Cash

For CFOs and Group CFOs leading large enterprises and conglomerates, the vast networks of entities, divisions, and global offices they manage involve huge capital. This complex business....

Read MoreHow does FinRecon’s Automation Slash Your Reconciliation Expenses?

For finance, accounts, and collections teams, the daily grind of reconciliation isn’t just about matching numbers – it’s a silent, draining expense. Are you ready to uncover....

Read MoreEscrow Management for Real Estate market – Rewritten for the Real World

If you’ve ever been part of a large real estate transaction, either on the banking side or the builder’s, you know it’s rarely as smooth as the....

Read MoreBeyond the Pixels: A Chat with Pramod Kumar

Hi! We’re here again! Today, as we pull back the curtain, you will unveil one of Teknospire’s absolute rockstars, the kind of wizard who turns complex fintech....

Read MoreModernising Treasury Management for Enhanced Liquidity Performance

Good cash flow is the key to any business’s success. Managing money the old way, with many separate systems and manual work, can be slow and complicated.....

Read MoreUnfolding The Hidden Costs of Manual Reconciliation

Manual reconciliation means countless hours, piles of spreadsheets, matching multiple transactions and chasing down discrepancies. Beneath all these lies a list of hidden costs that directly impact....

Read MoreBeyond the Pixels: A Chat with Bhavani Madhusudhanan

What if Teknospire is a bustling kitchen where innovative fintech solutions are cooked up, and Bhavani Madhusudhanan is one of our star chefs? She knows the right....

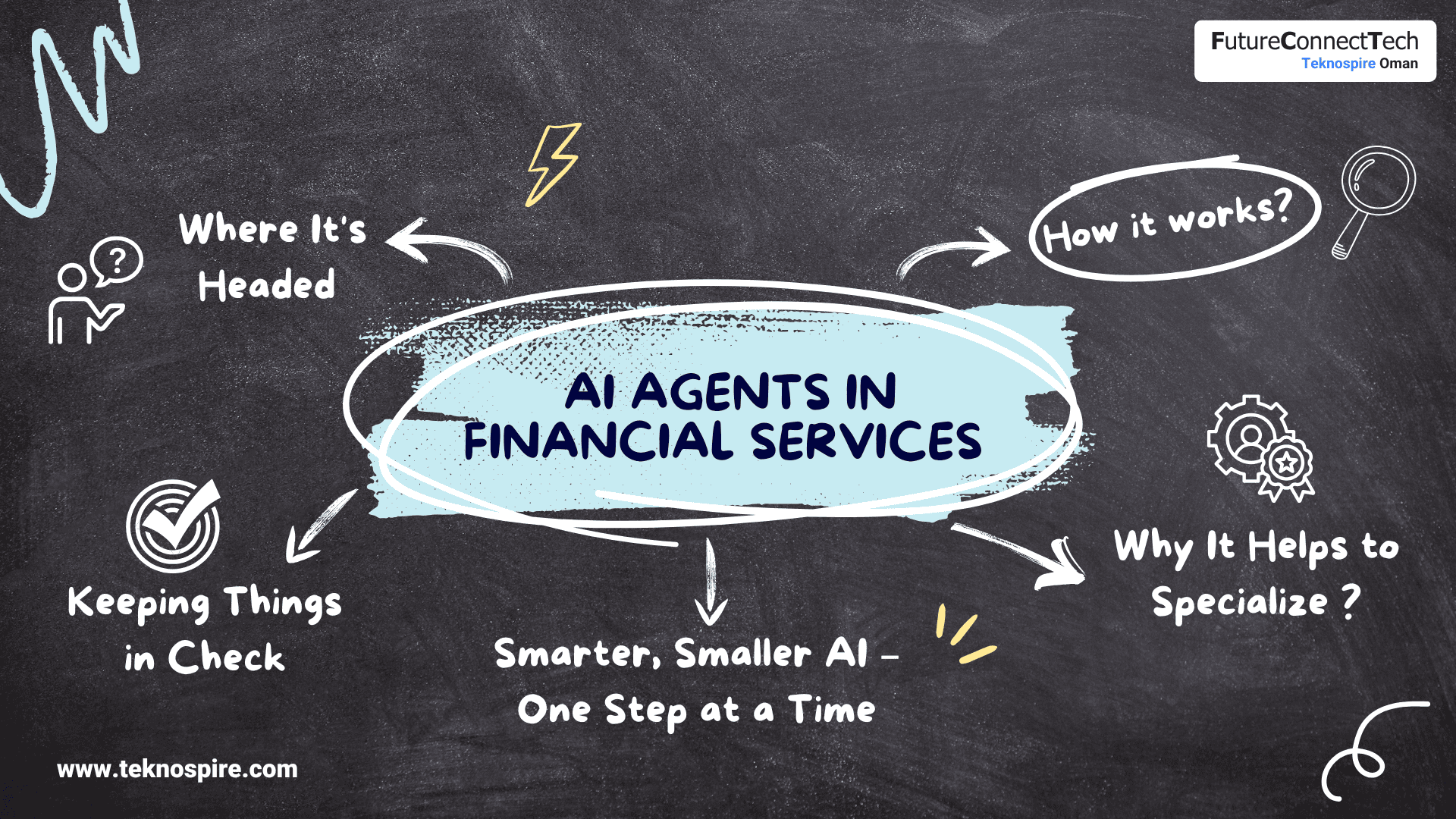

Read MoreThe Rise of Specialized AI Agents in Financial Services

AI in financial services is no longer just a buzzword. It’s quietly working behind the scenes, not in the form of big, futuristic systems, but as focused,....

Read MoreAccelerate Financial Close with Automated Account Reconciliation

Tik-tok round the clock! The month-end. The quarter-end. The year-end. The clock hands keep ticking, and the calendar pages keep turning. These periods often feel like a....

Read MoreSingle Account Treasury Management System Empowering Conglomerates

Is your treasury team having trouble managing your enterprise’s finances and constantly checking countless individual bank accounts? The sheer volume of transactions, disparate balances, and endless reconciliations....

Read MoreThe Evolving Landscape of Treasury/Cash Management System

Effective Treasury management Software is crucial for businesses of all sizes, helping them optimize liquidity, reduce financial risks, and streamline cash flow operations. With increasing globalization, regulatory....

Read MoreAchieve Financial Control Using Treasury and Reconciliation Automation

Did you know that manual reconciliation can consume up to 40% of a finance team’s time? In today’s fast-paced global economy, large conglomerates face the daunting task....

Read MoreWhy Banks Offer Treasury Management Systems

As businesses grow and operate across multiple markets, they require real-time visibility, greater control, and optimized liquidity management. Financial institutions (FIs) have an opportunity to enhance their....

Read MoreWhy does a business need Single Account Treasury Management?

For large conglomerates operating across multiple regions and business units, managing multiple bank accounts across different banks is a persistent challenge. CFOs and treasury teams struggle with....

Read MoreAgentic Payments: The Future of Smart Transactions

Imagine a future where AI handles your payments automatically with no manual input, no delays, and no human error. That’s exactly what agentic payments are all about.....

Read MoreOman Fintech Solutions: How Teknospire’s FCT Is Transforming Digital Finance Across the GCC

India-based fintech Teknospire is a leading provider of innovative products and solutions. With technological advancement, it continues to serve multiple African and Asian countries. Now, it is....

Read MoreDigital Escrow: Revolutionizing Trust and Security in Fintech Transactions

Digital Escrow services play a pivotal role in modern financial transactions, offering a secure and trustworthy method for managing payments between parties. In the fintech sector, digital....

Read More5 Steps to Streamline Inventory Reconciliation with FinRecon

Maintaining accurate inventory records is crucial for the success of any business. It often happens that the inventory counts in your records don’t align with the actual....

Read MoreHow to Streamline Bill Payments with AI?

With the rapid evolution of technology, every business and financial institution demands operational efficiency to streamline complex payment processes, handle volumes of transactional data and comply with....

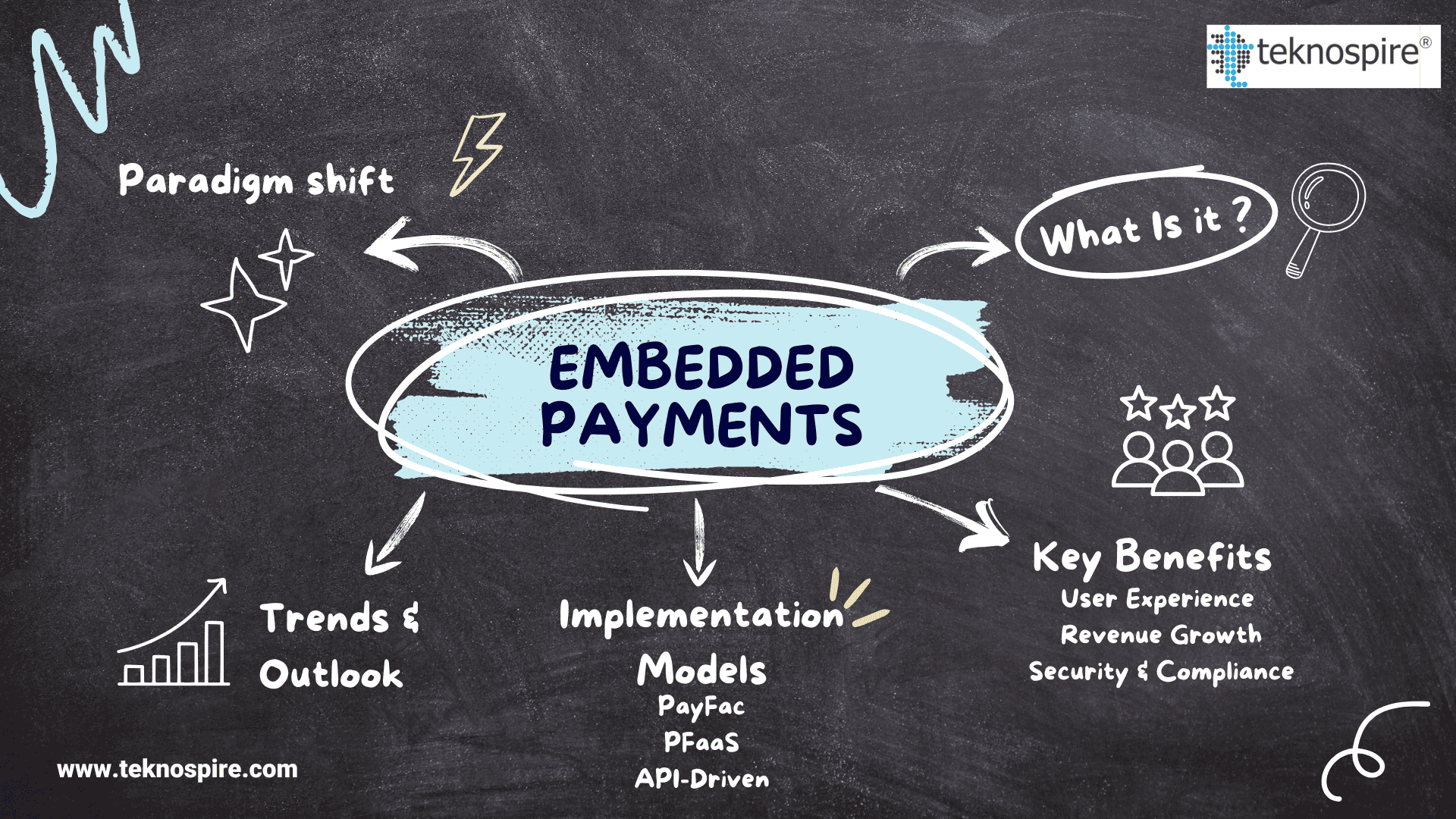

Read MoreEmbedded Payments: A Seamless Future for Digital Transactions

Embedded payment solutions are transforming digital platforms, allowing users to make secure, instant payments without ever leaving the platform they’re using. This shift represents a major advancement....

Read MoreHow does Reconciliation Platform Revolutionize & Reshape Industries?

Are you familiar with automating your account reconciliation processes? Yes, you heard that right. Organizations nowadays deal with huge volumes of data, which exist in various forms....

Read More