Finance teams are the backbone of every organization, ensuring smooth cashflow and accurate financial records. Yet behind the scenes, much of their time is often consumed by manual reconciliation, crosschecking bank statements, matching entries across ERP systems, and chasing down discrepancies.

It’s slow, stressful, and prone to mistakes. As businesses scale and payment volumes multiply, the pressure only grows. What once worked with a few spreadsheets can no longer keep pace with real-time transactions, multi-currency accounts, and complex reporting needs.

The Shift Toward Smarter Reconciliation

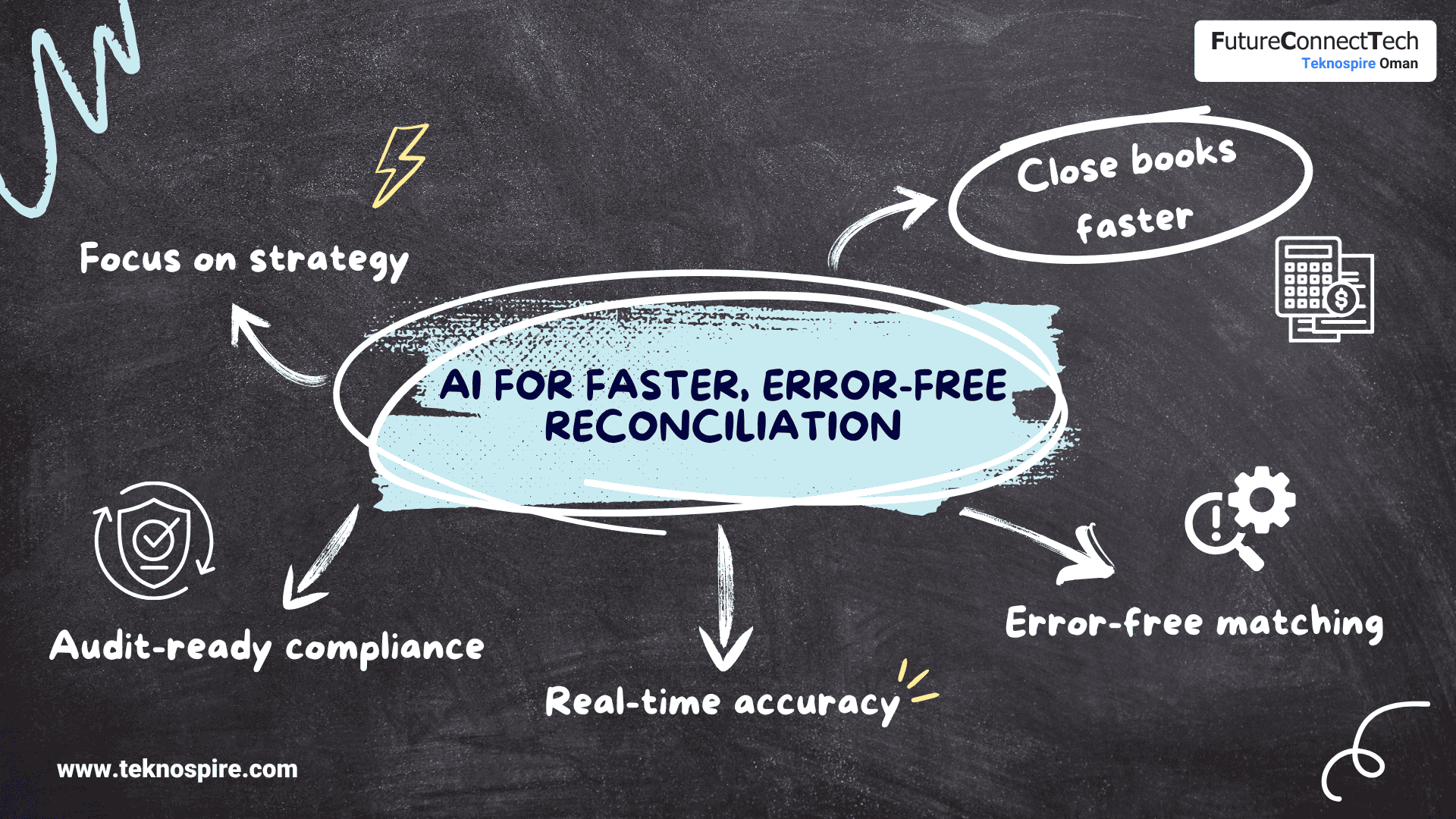

This is where automation, powered by artificial intelligence steps in. Instead of hours of manual checking, AI can instantly match records across sources, highlight mismatches, and even suggest resolutions. It learns over time, adapting to patterns and reducing the chance of repeated errors.

The impact is immediate: finance teams can close books faster, ensure greater accuracy, and spend more time on meaningful tasks like strategic analysis instead of firefighting errors. Just as importantly, automated reconciliation provides a clear audit trail, helping organizations stay compliant without the stress of last-minute fixes.

Why It Matters Today

In today’s business environment, speed and accuracy aren’t luxuries, they’re necessities. Companies need real-time insights into their cash position, liquidity, and risks to make confident decisions.

Relying on outdated manual processes creates unnecessary bottlenecks and blindsides leaders to what’s really happening in their financial operations. That’s why many forward-thinking corporates are turning to AI-powered reconciliation tools to modernize how their teams work.

FinRecon: Automation That Works for You

At Teknospire, we’ve built FinRecon to make this shift simple and effective. It brings together AI-driven matching, seamless integration with ERPs and banking systems, and transparent exception handling – all in one platform designed for corporate finance teams.

With FinRecon, organizations can accelerate month-end closings, minimize errors, and gain confidence that their reconciliation process is both efficient and audit-ready. More than just a tool, it’s a way to give finance professionals back their time to focus on strategy and decision-making.

The Road Ahead

As financial systems grow more complex, automation will become a cornerstone of corporate operations. AI-powered reconciliation isn’t about replacing human expertise; it’s about removing repetitive burdens so teams can focus on what truly matters.

Explore how FinRecon can help you modernize reconciliation and strengthen your financial operations here

Frequently Asked Questions

What is AI-Powered Auto-Reconciliation?

It refers to using artificial intelligence and machine learning to automate the process of matching financial records (e.g., bank statements, ERP entries), detecting discrepancies, resolving mismatches, and maintaining audit trails – replacing much of the manual effort in traditional reconciliation.

How does AI reconciliation differ from traditional/manual reconciliation?

Manual reconciliation often relies on human effort, spreadsheets, and rule-based matching, which is slow and error-prone. AI reconciliation can handle large volumes, learn from past matching patterns, deal with imperfect or unstructured data (e.g. mismatched names, missing invoice numbers), suggest resolutions, and provide real-time insights.

What are the main benefits for corporates using AI auto-reconciliation?

Faster month-end/fiscal close; fewer errors; reduced time spent chasing discrepancies; scalable process for growing transaction volumes and multi-currency accounts; better compliance and audit readiness; freeing finance teams to focus on strategic tasks.