Are you spending countless hours reconciling financial data across spreadsheets and files? The struggle with inaccurate financial records is tedious and drains costs and resources.

All of these seek a smarter and faster way to reconcile your finances. Every business demands accurate and efficient reconciliation to thrive. To meet such demands, businesses require automated reconciliation platforms like FinRecon.

With FinRecon, every business team can compare balances, identify discrepancies, and automate approvals and workflows. Let’s look at the struggles of manual reconciliation and how FinRecon helps businesses tailor reconciliation rules and gives them complete control over their reconciliation processes.

Challenges of Achieving Accurate and Efficient Reconciliation

Businesses face many challenges in achieving faster and smarter reconciliation with enhanced efficiency and accuracy:

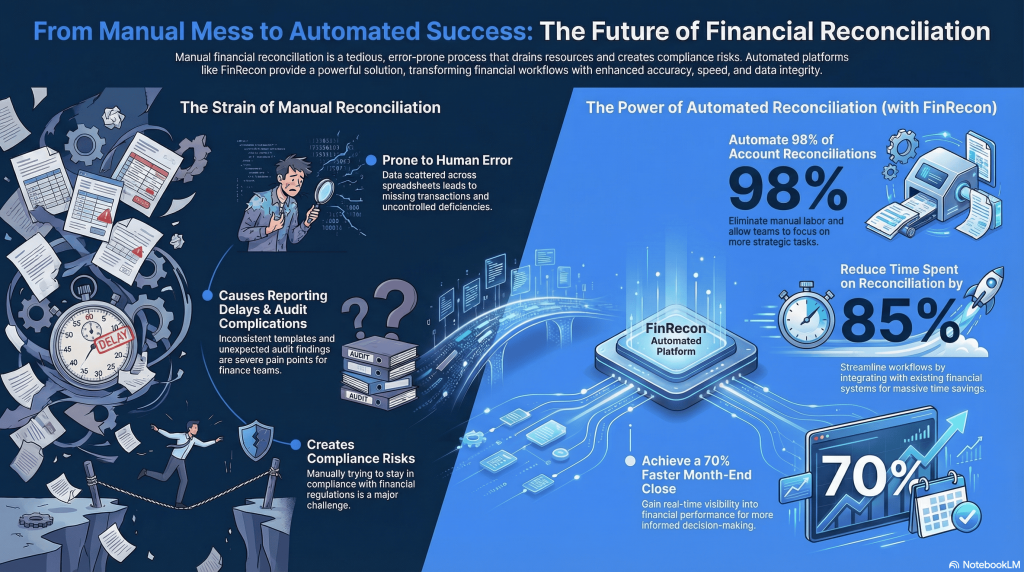

- Manual reconciliation processes need to be more accurate and prone to errors where the data remains scattered across individual spreadsheets and files.

- Missing transactions, discrepancies, uncontrolled deficiencies and unexpected audit findings are pretty common.

- Reporting challenges and audit complications are severe pain points faced by finance and accounts teams.

- Inconsistent account reconciliation templates lead to a lack of standardization and increased complexity.

- Staying in compliance with financial regulations is another major challenge.

Automated reconciliation platforms like FinRecon can be the most appropriate solution for defining reconciliation conditions and implementing consistent and standardized account reconciliation templates. However, it is important to understand the need for accurate reconciliation before adopting a smart solution.

The Importance and Value of Automated Reconciliation

Automated reconciliation via FinRecon serves as an indispensable tool helping businesses of all sizes streamline their process of comparing and matching financial records. It holds many benefits such as:

- Enhanced Data Integrity: FinRecon ensures the reliability of financial data by minimizing the risk of errors during data entry and comparison.

- Streamlined Workflows: Automated reconciliation solutions can integrate seamlessly with other financial systems to improve overall efficiency and save time.

- Informed decision-making: Real-time visibility into financial performance enables better decision-making and data-driven analysis helps businesses identify trends, risks, and opportunities.

- Improved productivity: Businesses can focus on more strategic tasks and reduce the need for manual labour and associated costs.

- Accurate reporting and audit efficiency: The automated reconciliation platform streamlines the audit process and ensures accurate financial reporting.

Steps to Implement Automated Reconciliation

Automated reconciliation with FinRecon is required to maintain financial integrity and make informed decisions. Considering the struggles and complexity of financial data, adapting this revolutionary platform is a wise decision.

The platform uses advanced algorithms to match and compare transactions accurately by automatically importing data from various sources. Discrepancies are cross-checked and verified. All possible errors are identified, and necessary resolutions are offered.

FinRecon also enables adjustments of necessary accounting records and access to comprehensive business reports and analytics with insights into the real-time reconciliation status.

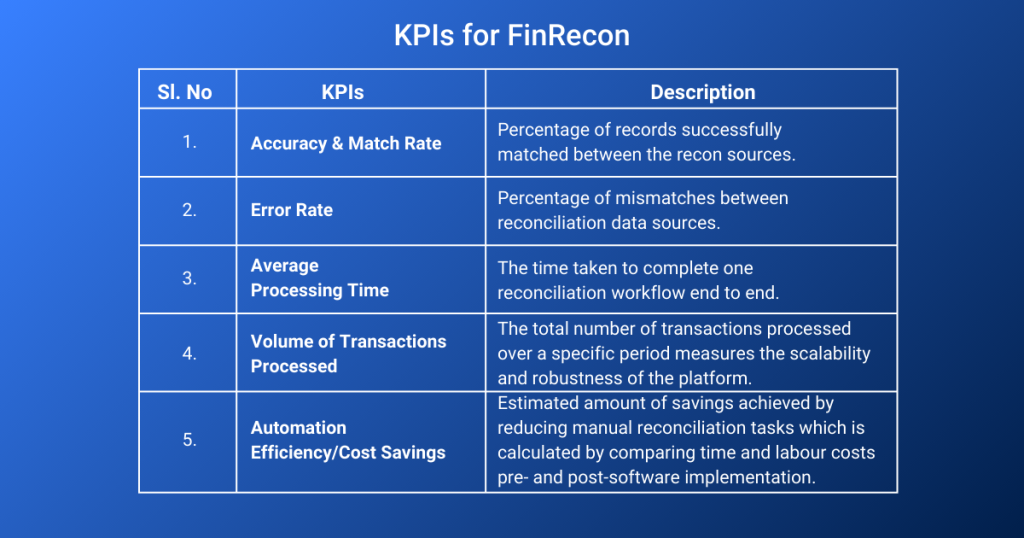

How to Measure the Performance of FinRecon?

Businesses can measure the performance of FinRecon by emphasizing the parameters stated below.

Check out the KPIs for FinRecon in the following table:

Adapt FinRecon for Better Accuracy and Efficiency

FinRecon is seamlessly adaptable and can easily integrate with the existing financial systems of all businesses. It can deal with large volumes of data where one can customize reconciliation rules and workflows as per needs.

We have a dedicated support team to help you with a quick and smooth implementation process and assist you throughout. With FinRecon, businesses have automated 98% of their account reconciliations and have successfully reduced 85% of their time spent on reconciling the data. They have also experienced a 70% faster month close.

Adapting FinRecon keeps businesses at an advantage with access to standard reconciliation templates, configurable reconciliation rules, purpose-built reporting, and standardized workflow management.

Case Study: Accelerating Reconciliation with FinRecon

A leading Qatar-based payment gateway streamlined its reconciliation process using FinRecon. The platform consolidated data from various sources, accurately matched transactions, generated detailed reports and automated the creation and distribution of settlement reports to merchants based on predefined rate cards.

In a nutshell, FinRecon helped the customer consolidate data, identify matches, generate reports and automate settlements.

Created with Google NotebookLM for illustrative purposes.

The Future of Reconciliation

Advanced features and cutting-edge technology of FinRecon are playing major roles in shaping the future of the industry. With continuous evolution every day, the entire team of FinRecon is adding in all efforts to embrace these emerging trends and investing a lot more in research and technology.

FinRecon promises to deliver innovative solutions to help businesses achieve greater efficiency, accuracy, and financial success. Experience the power of automation and transform your reconciliation processes with us.

Ready to take your financial reconciliation to the next level?

Join us for a demo session to learn more. Why is automated reconciliation required for businesses?

Frequently Asked Questions

1. What are Automated Reconciliations?

Automated reconciliation is a process that uses technology such as AI and ML to compare financial records from different sources, such as bank statements, ledgers, and accounting records. It reduces manual labour, and additional costs, saves time, improves accuracy and highlights discrepancies. It also provides fraud detection and offers real-time insights to businesses.

2. Examples of Automated Reconciliation Processes.

Some examples of automated reconciliation are – bank reconciliation, automated receivable/payable reconciliation, inventory reconciliation, expense and general ledger reconciliation.

3. Why is automated reconciliation required for businesses?

Businesses need automated reconciliation for enhanced accuracy, improved efficiency, better decision-making and risk management, cost reduction, and better compliance.