The year 2012 was a bit frustrating for Olympic tourist in London as VISA was the only card to be accepted. Banks in the US who have offered Mastercard to their customer were under pressure to issue new VISA cards to engage their loyal customer and earn revenue from international payments. For a developed nation like the USA that excels in technology adoption issuing new card may not be a significant task and that reflects in their growth and economy with flexible products, services, underbanked population dropping to 6.5%[ in 2017]. Indeed, U.S. is far ahead in innovation in the banking sector when compared to other countries. Our post of today would talk about these initiatives, opportunities, and examples of Digital Banking in the U.S.

Examples of Fintech-Bank Collaboration to enable Digital Banking in the US

Legence Bank integrating their CBS

Legence Bank in Eldorado, Illinois was looking for a tool that guides their customer on solid banking practices. They needed a tool that could integrate all customers’ accounts at one place and help them analyze their spending decisions. Collaborating with CSI, a fintech offering banking solutions that got integrated with their legacy banking system helped in educating young customers about making smart budgeting plans.

Live Oak Bank integrating with Plaid

Another interesting collaboration happened when Live Oak Bank in the US collaborated with Plaid to serve the small businesses and personal customers with security and speed. Live Oak Bank was looking for speedy on boarding process so that the customer could use the online banking platform within hours if possible and should be secured validating and following all legal processes. Plaid offered their secured solutions that helped Live Oak Bank in expanding their services to different verticals, and they also started offering personal banking platform to other regions.

Implementations / Examples of Digital Banking in the US

Banks need to draft a “Digital Strategy” to move and align with the digital wave. Each Banking services be it in Corporate Banking or Cards and Payments now has a Digital Solution available. What Banks need to work on is analyzing all aspects of Digitization and evolving truly as Digital Institution.

Let’s take a closer look at some of the banks in the US who followed banking trends and emerged victorious in serving tech-savvy millennials.

American Express

AmEx or American Express is a brand that doesn’t need an introduction in the US. Popularly known as “premium brand” it has been one of the banks that understand “How customer and relationship need to be nurtured while offering comfort and convenience.” An article covered by The Financial Brand dictates some of the “good things” that make AmEx a top choice in customers, sample these –

Onboarding Simple and Quick

AmEx bid goodbye to long paper forms, quick and easy onboarding process helps in saving customer’s valuable time. In fact the application for an American Express card is so simple that it takes ~30 seconds. Digitization Rocks!

Compatible With All Devices

Is your Banking form only compatible with Desktop? How about opening it on Tab? AmEx made sure that all the screen sizes and device compatibility is applicable for the application form to avoid any inconvenience to the customer

Integration of Third Party Plugins

AmEx always shows its value to its customers by displaying the comparison chart and dictating the actual value customer would derive. Does your banking software allow the customer to integrate with other third-party plugins to compare and make informed decisions?

Using Data effectively

AmEx uses data points not only to mitigate risks but also to detect fraud. Are you using your data effectively?

Above features may not be “newer innovations” but are making customer life more straightforward and that’s what distinguish you from your competitor.

Wells Fargo

Wells Fargo another leading bank in the US who led the Digital Banking initiative implemented Balance Scorecard [BSC] to track and measure the online financial services [OFS]. The case study that studies the implementation in the year 1997 and 1998 came up with the following conclusions –

It’s worth to highlight the fact that even in those days when digitization was not end to end Wells Fargo was able to reduce its cost by 22%, imagine with modern technologies and innovation how much operational cost could be reduced for a bank leading to an increase in profit margins.

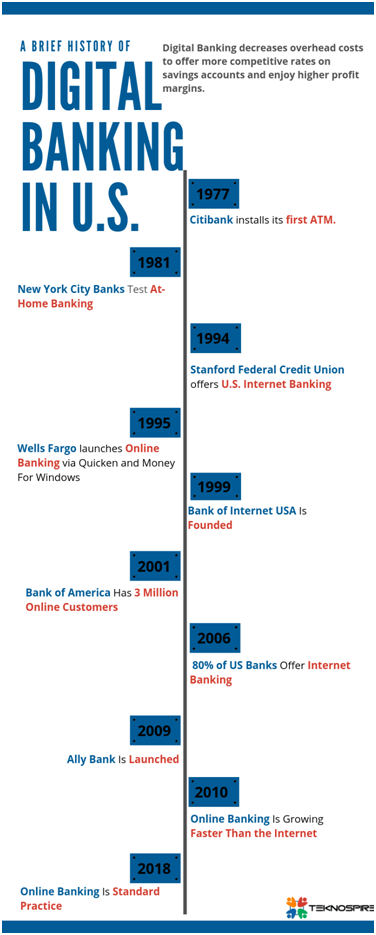

History of Banking and adoption of Digital Channel in the US

October 8 that is celebrated as National Online Bank Day triggers nostalgic feelings of banking to be a brick-and-mortar business. The simplefund’s transfer used to take 2-3 days and depositing a cheque on bank holiday was utterly forbidden. We have indeed come a long way of Banking ….

Initiatives in the U.S to adapt to Digital Banking

Stanford Federal Credit Union (or Stanford FCU) was one of the first to offer banking by telephone and conducting its first four internet transactions, introducing Online Banking to US residents.

Wells Fargo was the first bank to provide secure credit card transactions on the internet. As they celebrated 20 years of internet banking on their website in 2015, they mentioned – people being reluctant to avail banking services online.

An exciting story shared by early adopter is worth sharing –

One of the major hurdles faced by Banks in the past while adopting digital channels is “assuring security” to the customers. With lack of regulation, Banks themselves managed compliance to assure best services to the customers.

But with innovation in technology speeding up, there was a rise in adopting the Digital banking initiatives by the US residents. We now see tech-savvy millennials demanding IoT based banking services, easy acceptance to contactless payments and use of VR/AR in banking institutions.

Opportunities for Digital Banking in the U.S

Different modules of Banking have been digitized with Fintech and Bank collaboration, but as Banking is like the veins of any country’s economy, it has the potential to evolve further. Some of the innovative use cases being explored by enterprises in the US are –

Banking on the Internet of Things [IoT]

You may use Fitbit or another wearable to track your health, how about using it as a digital wallet and paying for your grocery at a shopping complex? Recently a collaborationhappened between Bank of America and FitPayto allow customers to make contactless payments directly from wearable devices at NFC-enabled point of sale (POS) locations and they can also be used at more than 9,000 Bank of America ATMs.

Hybrid and Serverless based architecture reduce cost

We have come a long way from data centers to cloud, containers, microservices and now serverless. While these trends are helping technologist, they could also help banks in reducing the operational cost, reduce time-to-market and increase performance. Capital One Bank in the US recently moved their traditional monolithic architecture to AWS serverless framework to manage its peer-to-peer payment systems.

Blockchain Helping Banks in Loans and Credit

To make loan process efficient, cheaper, secured and access to a large set of people Blockchain-enabled lending is the technology to adapt to. Traditional Banking accesses credit rating and verifies your bank accounts to judge the eligibility. Adopting to Blockchain technology allows Banks to open up the possibility of peer-to-peer loans, and complex programmed loans in a faster and more secure way.

Neo Banks, Challenger Banks – The current trend of “Digital Banks” in the US

Neo Banks or Challenger Banks are “Digital only bank” with no physical branches. If you are new to the Neo Banks concept, please read our earlier post – Different ways of Banking here.

Neo Banks are making noise in the US but sailing the verticals where regulation is less frustrating, and revenue generation are high which leads to two verticals – investing and lending. However, the take-off of Neo Banks in the US was disappointing with

- Simple a Banking a budgeting app that evolved but was acquired by BBVA, overridden by newer technologies and put off many new users.

- Bank Mobile another app designed to secure your finances was also acquired and not been in the news of acquiring new customers

However, the failure of Neo Banks in the US is understandable as they rely a lot on third-parties for technologies, regulation, distributions,etc. to keep the cost low and deploy changes quickly. Neo Banks which were in an infant stage quite recently have moved to “toddler stage” with Varo Bank the first fintech in the US to receive preliminary approval from the U.S. Office of the Comptroller of the Currency for a national bank charter. Some of the other players in the running in the race of Challenger Banks are Chime offering lending services and SoFi that also offers loans via the app.

How Teknospire can help Banks in enabling digital banking in the US

Teknospire a technology service provider to Banks and NBFC’s could assist in digitizing core banking, the launch of mobile financial services and be a change agent to enable Financial Inclusion. Our flagship product FinX is a “Bank in a box” that includes Data Analytics and Reconciliation products for banks to boost their marketing or automate manual settlement process. FinX ‘ addresses the 360º digitization of banking and payments, primarily addressing the last mile, without any extra hardware/capital expenditure

We have been serving in parts of Africa, Zimbabwe, India, Nepal, and part of Bangladesh. For more details on our products, please contact us here.

For an overview of Who we are, listen to our CEO, Vishal Gupta here.

On how Technology can enable inclusion, watch our video here.

References

- U.S. neo-banks: A digital revolution and its roadblocks

- Four Ways Banks Can Radically Reduce Costs

- Jack Bogle: The man who pioneered index investing

- History of Online Banking: How Internet Banking Went Mainstream

- Case study: Live Oak Bank and Finxact – riding the second wave

- Case Studies

- 4 use cases of personalisation in digital banking

- Banks and Fintech