If you’ve ever been part of a large real estate transaction, either on the banking side or the builder’s, you know it’s rarely as smooth as the brochures suggest. Between milestone payments, documentation chaos, and regulatory friction, the process often feels more like juggling than managing. That’s where escrow steps in: a buffer zone of trust, a safety net for both funds and expectations. But even escrow, in its traditional form, is showing signs of strain. Old systems weren’t built to handle today’s pace, complexity, or the number of hands involved in a single deal.

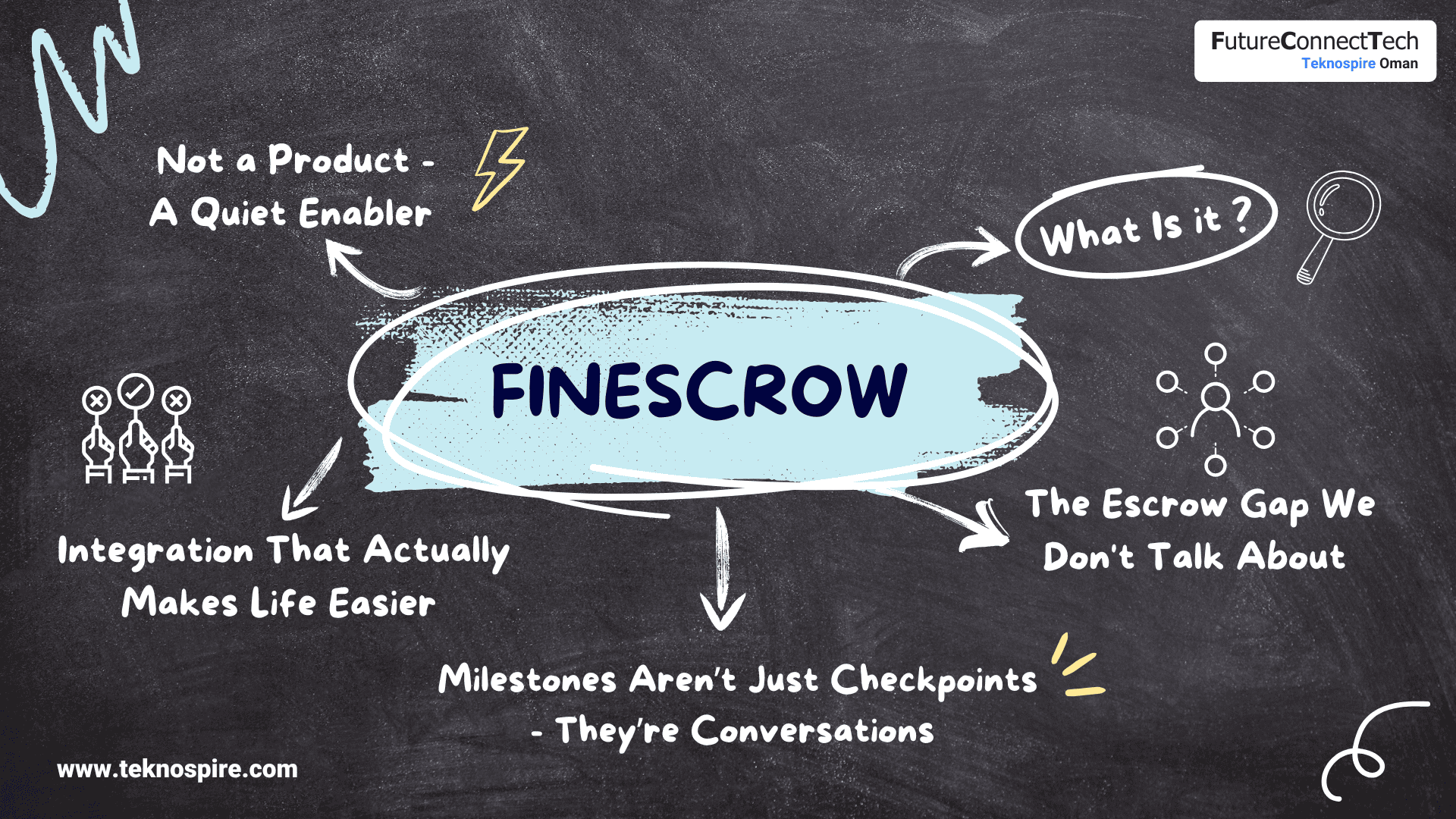

The Escrow Gap We Don’t Talk About

In practice, managing escrow isn’t just about holding money. It’s about coordinating between banks, developers, buyers, government bodies, and sometimes, third-party consultants. And it’s here, in this messy middle, that many transactions slow down or derail. Delays in verifying documents. Confusion around payment triggers. Disputes over whether a milestone was truly met. These issues don’t make headlines, but they quietly stall projects, stress out teams, and tie up capital.

A System That Understands the Workflow

What if escrow management respected the complexity instead of resisting it? That’s the principle behind FinEscrow. It wasn’t built to add another tool to your tech stack. It was built to mirror how real estate transactions actually unfold.

- Developers don’t just need a bank account, they need a digital map of their entire project: units, buyers, stages, and triggers.

- Banks don’t just release funds, they evaluate documents, run compliance checks, and coordinate with housing ministries.

- Buyers don’t just pay, they want transparency on where their money goes, when, and why.

FinEscrow pulls these moving parts into a single narrative. One that’s visible, verifiable, and less prone to costly misunderstandings.

Milestones Aren’t Just Checkpoints – They’re Conversations

One of the more thoughtful features is how FinEscrow handles milestones – not as rigid checkboxes, but as live status updates across stakeholders.

A consultant verifies a phase. A bank gets notified. A buyer sees progress. And only then does the system trigger a fund release. This avoids the classic “he said, she said” bottlenecks that plague escrow flows.

Integration That Actually Makes Life Easier

In real estate finance, tools should make things simpler – not create more work. FinEscrow connects easily with the systems banks and developers already use. It shares updates with government portals like the Ministry of Housing and works smoothly with the bank’s core software, so there’s no need for manual updates or switching between platforms.

It also handles agreement creation digitally cutting out paperwork and back-and-forth emails. Because if it still takes a dozen emails to release one payment, something is not working.

Not a Product – A Quiet Enabler

Here’s the thing: you shouldn’t notice FinEscrow doing its job. You should just feel like things are…less stuck. Documents flow, alerts ping the right people, approvals line up, and money moves when it’s supposed to. That’s not magic. It’s just design that starts from reality, not aspiration.

Conclusion

Escrow has always been about trust. But in today’s fast-moving world, that trust comes from transparency, timely updates, and clear handshakes between all parties. In real estate, where payments are tied to milestones and multiple stakeholders are involved, FinEscrow brings structure and clarity, thus making the process easier to manage for both developers and banks.

Beyond real estate, FinEscrow also helps financial institutions handle other escrow use cases with the same reliability, simplifying approvals, reducing delays, and improving coordination where it matters most.