Guide to Digital Escrow in the GCC: Securing Real Estate & High-Value Trade

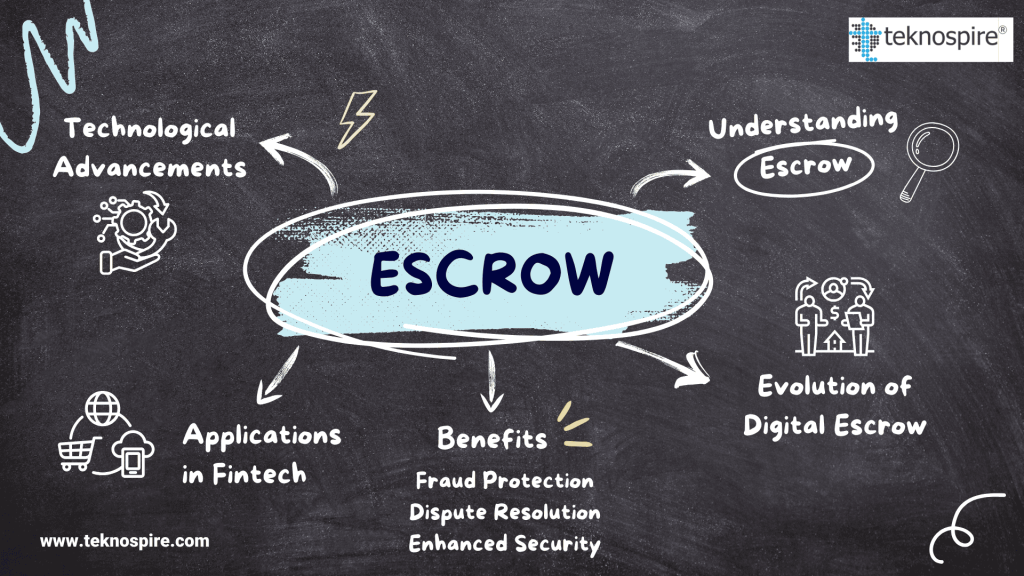

In the high-stakes world of GCC real estate and cross-border trade, trust is the primary currency of exchange. As Saudi Arabia and the UAE witness a surge in multi-million dollar transactions, the traditional handshake and wire transfer model is no longer sufficient. Digital Escrow is the need of the hour, for it provides a sophisticated financial safeguard that ensures security, transparency, and compliance for all parties involved. To understand the concept better, we must know that an escrow account is a secure, temporary vault managed by a neutral third party (agent) to hold funds or assets. Its purpose is to eliminate the trust deficit in high-value transactions, protecting both buyer and seller. Leveraging Teknospire’s automated escrow management platform, FinEscrow, real estate developers gain faster access to funds post-milestone, improved cash flow and planning, full project and payment transparency and higher buyer confidence. Simultaneously, buyers are assured that funds are only used when work is completed, with transparency into payment history and project milestones, real-time notifications, digital receipts, and greater confidence in the property purchase. This guide explores how FinEscrow is transforming high-value trade through automation and intelligence. What is Digital Escrow? Digital Escrow is a financial arrangement where a regulated third-party platform holds and regulates payment of the funds required for two parties involved in a given transaction. Why is it essential for GCC trade? In the GCC, where cross-border trade and large-scale infrastructure projects are the norm, it mitigates the risk of non-payment or non-delivery. Using FinEscrow in GCC trade is necessary, for it acts as a neutral safeguard. Funds are only released from the escrow account when pre-defined contractual milestones are met, providing a neutral ground for buyers and sellers. What are the exclusive features of FinEscrow? The escrow platform offers unmatched control and clarity to banks processing thousands of real estate transactions: How does FinEscrow build trust in High-Value Real Estate transactions? Real Estate is the cornerstone of the GCC economy, but it is often plagued by perceived risk during the transfer of ownership. FinEscrow builds trust by providing: Can Digital Escrow handle the complexity of N-Level hierarchies? FinEscrow utilises an N-Level Hierarchy to manage multi-party deals. For instance, in a large construction project, an escrow account can be partitioned into sub-accounts for various contractors and suppliers. This ensures that the main developer’s funds are protected while guaranteeing that subcontractors are paid immediately upon verified delivery. A Dual-Sided Advantage: The Stakeholder Benefits By leveraging Teknospire’s automated escrow management platform, FinEscrow, the entire ecosystem gains a competitive edge. For Real Estate Developers & Sellers For Buyers & Investors How does AI make FinEscrow different from traditional bank escrow? Traditional bank escrow is manual, slow, and reactive. FinEscrow is proactive. Its AI-First Design allows the platform to: Is FinEscrow ready for the Open Banking era in the GCC? FinEscrow is built on an Open Banking-Ready architecture. It doesn’t just sit in a silo; it connects seamlessly with the existing ERP and regional payment rails. This allows for hyper-speed precision funds move the moment a milestone is cleared, optimising the working capital of every party involved. Why Leading GCC Entities Trust FinEscrow? To understand why high-value trade in GCC trusts FinEscrow, one must understand the difference between traditional and digital escrow management platforms. Features Traditional Escrow FinEscrow (Digital) Speed 5-7 Business Days Instant / Milestone-Triggered Visibility Paper-based / Periodic Real-Time Digital Dashboard Automation Manual Verification AI-Driven Smart Milestones Security Physical Documents Bank-Grade Encryption & RBAC Experience the Future of Secure Trade As the GCC transitions toward a digital-first economy under Saudi Vision 2030, the need for secure, automated, and intelligent transaction management has never been higher. FinEscrow by Future Connect Technology (FCT) provides the intelligence, scale, and trust required to thrive in the modern market. Whether you are a real estate developer, a high-value commodity trader, or a government entity, FinEscrow promises to bring a level of trust and speed to your next transaction. Hope this guide helped you understand how to set up secure, efficient digital escrow for your high-value deals in the GCC. Request a FinEscrow demo today! Frequently Asked Questions