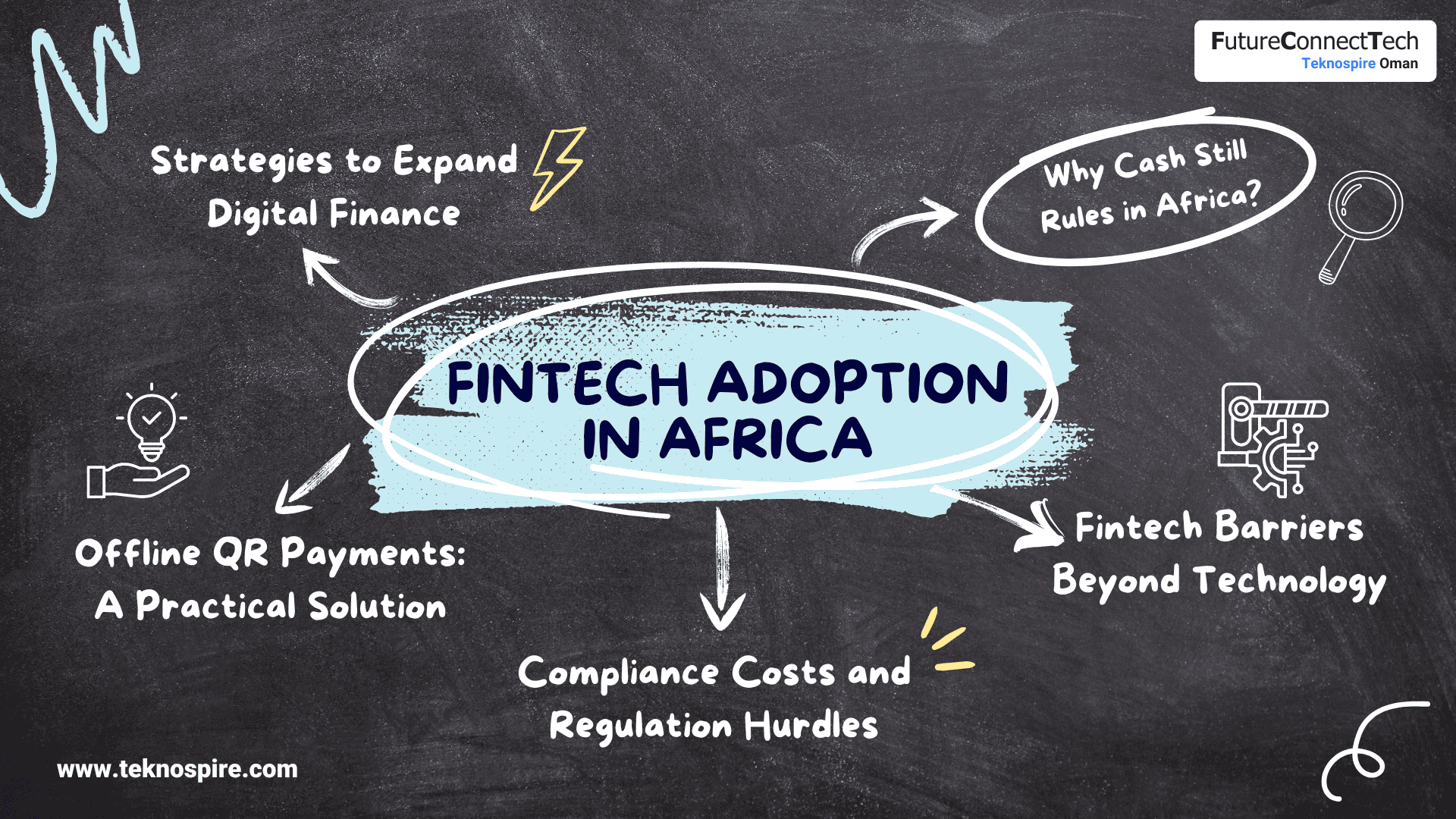

Fintech adoption in Africa shows a striking contrast. In countries such as Kenya, Nigeria, and South Africa, digital payments and mobile financial services are widely used in cities and connected corridors. At the same time, across many rural and low-income communities in Sub-Saharan Africa, cash still dominates daily transactions.

This is not due to a lack of demand for digital finance. Instead, it reflects differences in infrastructure, connectivity, regulation, and economic structure between advanced urban markets and under-served regions. While leading fintech ecosystems continue to innovate online and in real time, large populations still face barriers such as patchy internet access, fragmented payment rails, and high compliance costs for providers.

This article focuses on those under-served segments and regions, explaining the key barriers that slow broader, inclusive fintech adoption and how practical approaches such as offline QR payments can help bridge the gap between cash and fully digital systems.

Why are Many Regions in Africa Still Highly Cash-Dependent?

Even in countries that are fintech leaders overall, cash remains dominant in rural areas and informal markets.

Key reasons for cash dependency:

- Large informal economies where transactions are unrecorded

- Limited smartphone and internet penetration in rural areas

- Low trust in digital systems due to fraud concerns

- Immediate liquidity needs for daily wage earners and small merchants

For many consumers and micro-businesses, cash is reliable, universally accepted, and does not depend on connectivity or digital literacy.

Impact on fintech adoption:

Heavy cash usage reduces the amount of digital transaction data, slows merchant acceptance of digital payments, and delays the shift toward formal, trackable financial services outside major urban centres.

How Fragmented Infrastructure Slows Fintech Growth?

Africa’s financial infrastructure has developed unevenly. Some countries have matured instant payment systems and strong mobile money interoperability, while others rely on siloed banks and wallet networks.

Common infrastructure challenges:

- Lack of interoperability between banks and mobile wallets

- Inconsistent payment rails across regions

- Dependence on real-time internet connectivity

- Limited access to core banking APIs for fintechs

This means a solution that scales easily in, say, Kenya’s mobile-money ecosystem may require major rework to operate in a neighboring market.

Impact on fintech adoption:

Higher integration and connectivity requirements increase costs, slow rollouts beyond major hubs, and create inconsistent user experiences across regions.

Why Compliance Costs Are a Major Barrier for Fintechs?

Regulatory compliance in Africa is complex, expensive, and highly localized.

Key compliance challenges:

- Multiple KYC and AML frameworks across countries

- High costs of customer due diligence

- Frequent regulatory updates and reporting requirements

- Limited access to national digital identity systems

For early-stage fintechs and financial service providers, compliance can consume a significant portion of operational budgets.

Impact on fintech adoption:

High compliance costs reduce innovation, delay product launches, and limit fintech services to urban or high-value customers.

How Offline QR Payments Can Drive Wider Adoption?

Offline QR payments are designed for exactly these lower-connectivity environments.

They allow a transaction to be initiated and cryptographically validated on the spot, then synchronised with the core system once connectivity is available.

How offline QR payments help:

- Enable transactions without internet connectivity

- Support low-cost smartphones and feature phones

- Reduce dependency on POS hardware

- Improve acceptance among small merchants and rural users

By allowing transactions to be authenticated and synced later, offline QR systems bridge the gap between cash-based economies and digital finance.

Strategic benefit:

Offline QR payments expand digital payment reach while respecting local infrastructure limitations.

Strategies to Accelerate Fintech Adoption in Africa

To extend fintech success beyond already-advanced urban markets, providers and regulators need “offline and interoperability first” thinking.

Key strategies include:

- Designing offline-capable and low-bandwidth payment flows

- Building interoperable, shared financial infrastructure

- Applying risk-based and tiered KYC for low-value accounts

- Partnering with banks, MFIs, agents, and mobile network operators

- Investing in user and merchant education to build digital trust

Platforms that combine regulatory compliance, infrastructure flexibility, and local usability will lead to the next phase of fintech growth in Africa.

The Road Ahead for African Fintech

Fintech in Africa is not held back by lack of innovation or demand. In leading markets, digital finance is already mainstream. The real challenge is extending those gains to regions where connectivity, infrastructure, and compliance costs still favor cash.

Solutions that acknowledge this diversity supporting both always-online urban users and intermittently connected rural communities will scale faster and more sustainably.

By enabling innovations such as offline QR payments and interoperable platforms, fintech providers can move beyond pockets of excellence and drive truly continent-wide financial inclusion.

Frequently Asked Questions

What are the main challenges to fintech growth in Africa?

Fintech growth in Africa is constrained by uneven infrastructure, fragmented payment systems, limited internet penetration in rural areas, and heavy reliance on cash in informal economies.

How do regulations slow fintech adoption?

Regulation slows adoption because each country has unique licensing, KYC, and AML requirements, increasing legal costs and making regional expansion difficult.

Why is cash still dominant despite mobile money?

Cash remains dominant where connectivity is poor, digital trust is low, and infrastructure cannot reliably support continuous online payments – especially in rural and informal markets.

What role does trust and digital literacy play in slowing fintech use?

Low digital literacy and fear of fraud reduce trust in digital finance, discouraging users from adopting fintech tools and keeping cash as the safer, familiar option.

Can offline payment options help small businesses and informal traders adopt fintech faster?

Yes. Offline payment options like offline QR codes help small merchants and users transact without needing constant internet, making digital finance more accessible in low-connectivity environments.