We human are strange in behavior. First, we look for various options, and then we look for one option that serves to all. Don’t believe me? A single Windows login to access all your office systems? A single FB /Google login to access most of the third-party applications? An OS that runs on phones, tablets, and desktops? A device that allows you to make audio and video calls? A universal language? And the list could go on…

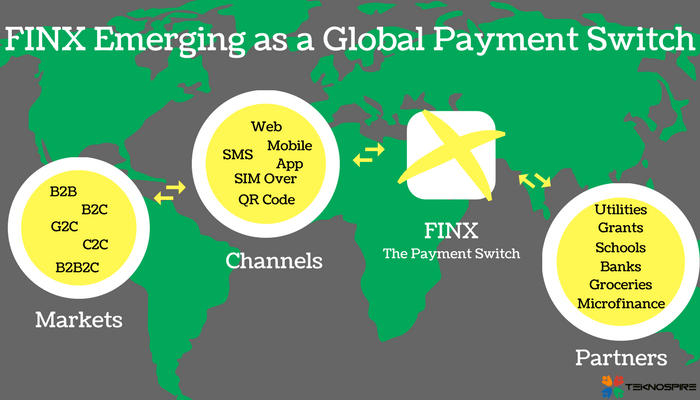

Talking about the new technologies, while people are trying to put Bitcoin as the global currency, we @Teknospire working on a payment switch FinX that has the potential to serve as a global switch connecting different markets, channels, and partners. Vishal Gupta the CEO of Teknospire says – We are living in the age of inventions and innovations, while NPCI is emerging as a National Transaction Switch [NTS], there is a dire need of a global transaction switch that connects countries, continents, oceans that is compliant and follows regulation.

FinX is a payment switch solution that could be integrated with any Banking solutions to avail value added services and banking services that are cost effective and could be availed from any location. Some of the key features of FinX – The Payment switch are –

Talking about why FinX is distinctive Vishal Gupta says- Without reinventing the wheel, FinX has adopted a lot from NPCI’s way of architecting a complex switch catering to all possible channels, be it direct to consumer or via assisted retail. Specific transactional logics especially at the last mile which addresses the grants, donations, micro loans repayments, insurance repayments, pensions and ghost workers etc. Along with these non-banking services, the FinX switch also integrates with banking ecosystem over ISO standards with a real time Business Intelligence (BI) built in. FinX is the move towards Banking v3.0 and catering to nations needs of aggregated transactions.

If you are still wondering how to use FinX payment switch for your business, here are the specific use cases.

B2B Markets

Some of the leading B2B firms in India are Mjunction, AmazonBusiness , TradeIndia, IndiaMart, etc. The Business to business[B2B] firm deals with other business. Just, for example, a nationalized bank, while transforming digitally would need the software solution that could help them maintain ledgers, users data, accounts etc. These services could be availed from another software business that helps banks in initating and maintaining the Digital ledgers, accounts etc.Experts believe that by 2020 the B2B in Indian e-commerce would rise to Rs 45 lakh crores.

With such a fascinating growth, most of the B2B owners need technology involvement to avoid paper-based methods [bank cheques] for a smooth transition. They are looking for technology-driven payments options that could help them in optimizing cash flow, tax regulation and most importantly fast and reliable processing.

With FinX- the payment switch the businesses could make fast and smooth money transfer for the deal via any channels like Web-based, via mobile app or an SMS, SIM over or scanning of QR code.

B2C Markets

The consumer demands home deliveries, cashless mode, hassle free returns of goods purchased and anytime anywhere access. With the number of wallets, payment banks, and other payment options in place it is difficult for consumers/business to sign up for all services. That’s where FinX the payment switch comes into play.

If from an online store customer buys some stuff and has just a digital wallet on his mobile phone to pay. The business could use the payment switch to connect the consumer digital wallets with business users account. So, no matter what payment mode the consumer has with FinX the digital switch most of the business could provide different payment option to their consumers.

G2C Markets

In every country Government to Consumer [G2C] markets make huge efforts and investments to enhance productivity and competence by implementing e-government services, to contribute towards the socio-economic development of a country. In India, itself the grants received under various schemes or subsidies offered to rural people, in most of the cases is not received by them.

FinX – the payment switch could help these grants/financial support via schemes like Atal Pension Yojna or Sukanya Samriddhi Yojna to reach the last mile. With the adoption of mobile phones, users could use SIM Over or SMS channels to access the partners like banks, schools or e-commerce and get the benefits they deserve. With an omnipresent channel, FinX , government and the consumer does not need to tie up with all partners but could still avail the benefits.

C2C Markets

India has seen a considerable rise in its Consumer to Consumer [C2C] markets, thanks to the adoption of mobile phones, improvement in mobile broadband/Data plan, supporting government policies, technology innovation in e-commerce platform and the ever-growing entrepreneurship.

While experts feel C2C markets, most of the consumer rely on Cash on delivery mode; things are changing with the recent stress on the Cashless mode by the government. While consumers have now started putting classifieds on OLX and Airbnb, the firms need to provide different payment option that could serve different customers via various channels.

FinX – the payment switch is just an intelligent and reliable solution to meet the trust factors of customers and serve different firms as a switch to connect to partners via different channels.

B2B2C Markets

The beauty of B2B2C[Business to Business to Consumers] markets is that customers could reach to them via multiple channels. While serving through multiple platforms comes the challenge to cater to all customer needs in terms of payments. While one customer may look for a pick-up store and insist on paying through credit card, another one may simply use his net banking mode.

To cater to each business and customer, B2B2C firms need a universal solution – FinX – the payment switch that allows business to opt for their preferred mode of payment and customer to choose how they want to avail the services. A win-win for all.

The payment that was earlier via barter system has evolved with the modern times. Today we see Payments Banks and Digital Wallets in demand, maybe tomorrow it would be bitcoin and cryptocurrency, what is essential in a universal solution that could work with changing technologies and does not bother business and consumers to adopt to new payment options each time. For such changing time – a global solution FinX is the answer.

References:

B2C Payment Tech Trends Energize The B2B Market

Is B2B ecommerce gaining steam in India?

e Payment Framework for g2c e Government Services

C2C: the next frontier in mobile payments is all about trust

Online C2C marketplaces can close India’s consumption gap