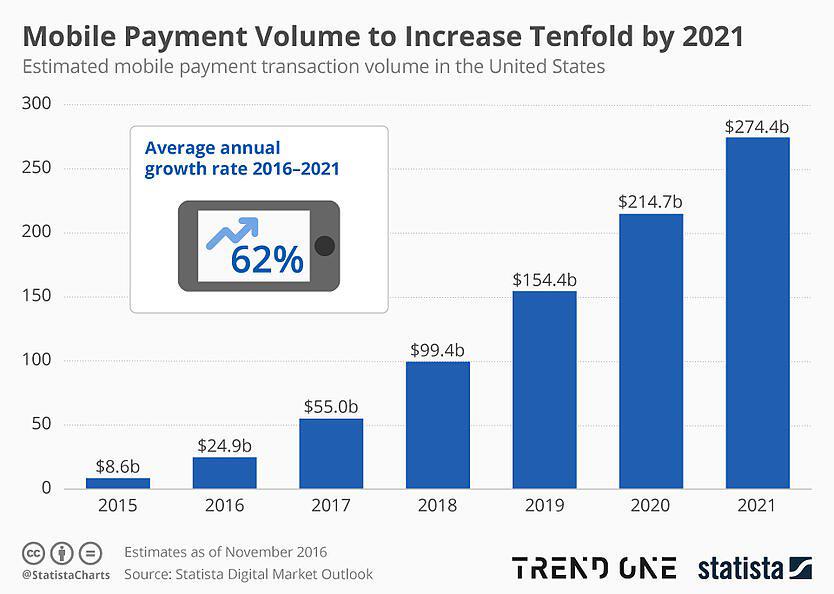

Mobile Wallets has grown rapidly in India. As per a BI Mobile Payments report, in-store mobile payments would grow to $503 billion by 2020. As per another report Mobile Payment Volume would increase tenfold by 2021.

Who are The Enablers to Mobile Payment?

- Growth of e-commerce

- Increased Penetration of smartphones

- Free and easy access to the Internet

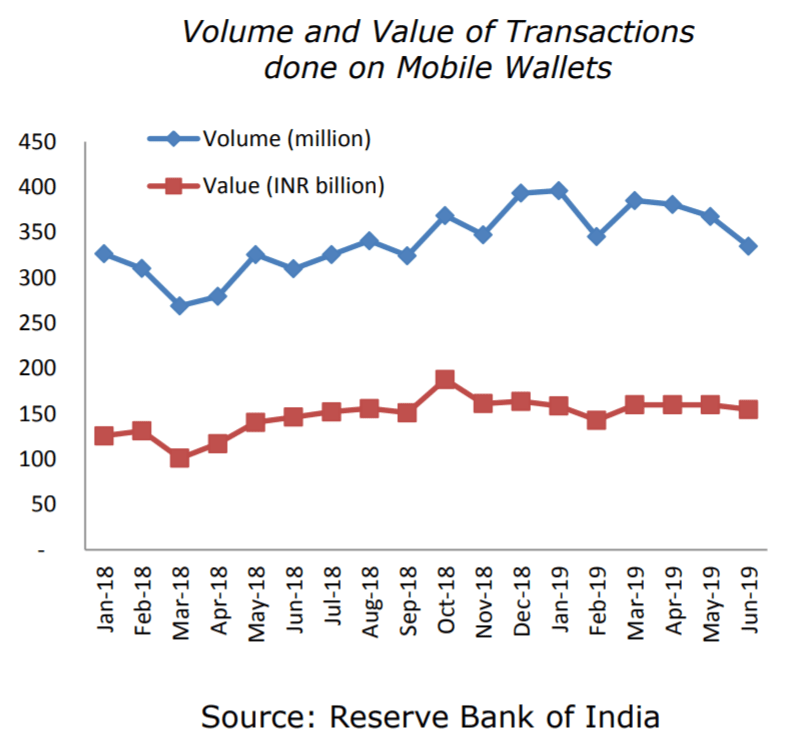

In fact with such supportive ecosystem from government, technology, and people adopting the change, numbers below show the positive growth trend in the adoption of mobile wallets in India.

| Quarter | Feature | Data | Growth/Decline |

| Q2 2019 | Number of transactions done | INR 1.08 billion | an increase of 18.4% over Q2 2018 |

| Q2 2019 | the value of transactions | INR 474 billion | an increase of 17.5% over Q2 2018 |

Mobile Wallets vs UPI in India

UPI is giving a tough competition to mobile payments in merchant recharges and transactions. Here are the numbers comparing the growth –

| Q2 2019 | the number of transactions done on mobile wallets | 1.08 billion INR | an 18.4% increase |

| Q2 2019 | the number of transactions done on UPI | 2.27 billion INR | The increase was a massive 263%. |

However, Customer behavior shows that UPI and wallets, both easily accessible via mobile apps, are considered interchangeable as each offers their own set of advantages –

| Mobile Wallet | UPI |

| Can be easily loaded with Cash or Credit Card | Can be directly linked to a Bank Account |

| Less and limits the risk of Cyber Fraud | |

| No need for KYC as directly linked to a govt account | |

| Due to its long presence, customer get more offers and Cashback | |

| Offers direct cashback to the bank account |

Irrespective of the mode one chooses, the only thing that matters is the customer’s experience and is he satisfied with the services? Mobile wallet offer convenience, security and seamless customer experience.

If you are keen to assist your customers with digital wallet services, we are just a call away. You can read about our services here.