How Open Banking can Help in Financial Inclusion

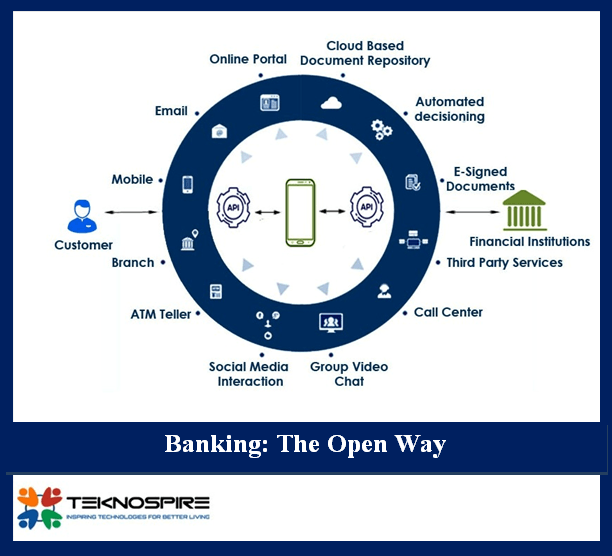

Jonathan a villager who supplies vegetables to the branded supermarket in the city needs to submit monthly invoices [physical copy] to get the payment.He has a bank account but still has to maintain a physical copy of the number of vegetables supplied with the offer price. Recently he got to know about a software that could do the maths, generate an invoice and submit it to the concerned vendor. Vendor on receiving the invoice can release the payment directly to his bank account, that is accessible to Jonathan on the software/app via open banking. Welcome to the World of Open Banking that is enabling Financial Inclusion. How Open Banking can Enable Financial Inclusion Financial inclusion a concept that ensures all households and businesses, irrespective of income level, have access to and can efficiently use the suitable financial services they need to enhance their living. On the other hand, Open Banking initiative assures customers get a secure, agile and rich customer experience. The two initiatives are to benefit “THE CUSTOMER” then why not let them collaborate and access manifold advantages. The Problems Faced by Individuals/Businesses in rural/remote areas Access to Banks and Banking is tough and costly Even though individuals have a bank account, they are not in an operational state or dormant as operating the bank account is like traveling to a distant town. Lack of Financial Education High-interest rates for businesses who are in need of loans Lack of transparency leads to broker/dealers conning individuals and enterprises The absence of proper banking services limits their capability while collaborating with urban clients. Could Open Banking Help in Solving the problems? Let’s pick each case and analyze if Open Banking could resolve these problems. Accessing Banks and avoiding DORMANT status Fintech, Banking technology and government initiatives are helping individuals to open a bank account with the help of technology. With banks now equipped with digital channels, opening a bank account could be done via Bank Agents or Agent Banking. These foot soldiers’ are authenticated by respective banks to be the middlemen between the bank and the customer. With the digitization and availability of smartphone, banking apps are installed on the phone and all the services availed by the customer have a track record providing transparency to the process. Open Banking helps users to access the bank account via authorized third-party apps, assist in bill payments, funds transfer thereby keeping the account in ACTIVE status. Access to Financial Literacy Thanks to innovative fintech models and open API that you can download an app on your mobile hook it to your bank account and learn about different terminologies like what is savings account? What interest rates mean? How are interest rates calculated? Etc. All of this could be accessed in your native languages, thanks again to open API and open data. Interest Rates Offered as per Regulatory Orders If an individual applies for a personal loan to the bank, with digitization in a place, he would be offered the interest rates as approved by the regulatory authority of the country. In cases where an individual is served by different banks, he/she can use a third party app using Open API model to compare which bank/fintech firms offer the lowest interest rate? Access to Growth and Opportunity The same example of Jonathan would be the most apt here as with Open API module, and Open Banking concept applied, Jonathan now could reach out to more urban clients without the need to leave his native place. Teknospire enabling Financial Inclusion with Open Banking Teknospire growth has been a structured one, each module evolving in a planned manner, approaching digitization one at a time. With an Open API design, the salary automation platform designed for civil servants of Zimbabwe was seamlessly connected to government payrolls and corporate ERPs. Next move was to offer a platform that helps the customer to pay bills, recharge and funds transfer and Bill Automation platform or micropayments digitization birthed. Next module was to help solopreneurs or banking agents and we launched Agency and Payment Module for individuals to access the digital platform and help in last mile banking. With a stable ecosystem, rich customer base, and tested platform the small and cooperative banks saw an advantage to extend their reach. With a lean banking layer or Agent Banking solution as a new addition to our offerings. Banks trusted us as the technology provider, and started collaborating with us where they get Merchant Banking, Agent Banking, Automatic Reconciliation, Micropayments as solutions. The beauty of all these modules has been the standalone working, enabled with Open API architecture. The Banks or NBFCs or microfinance firms could either sign in for all modules as one suite or could get one module of their choice. With Open API it helps firms to integrate with their systems smoothly.