Digital Escrow services play a pivotal role in modern financial transactions, offering a secure and trustworthy method for managing payments between parties.

In the fintech sector, digital escrow solutions have become essential, ensuring the safety and efficiency of online transactions.

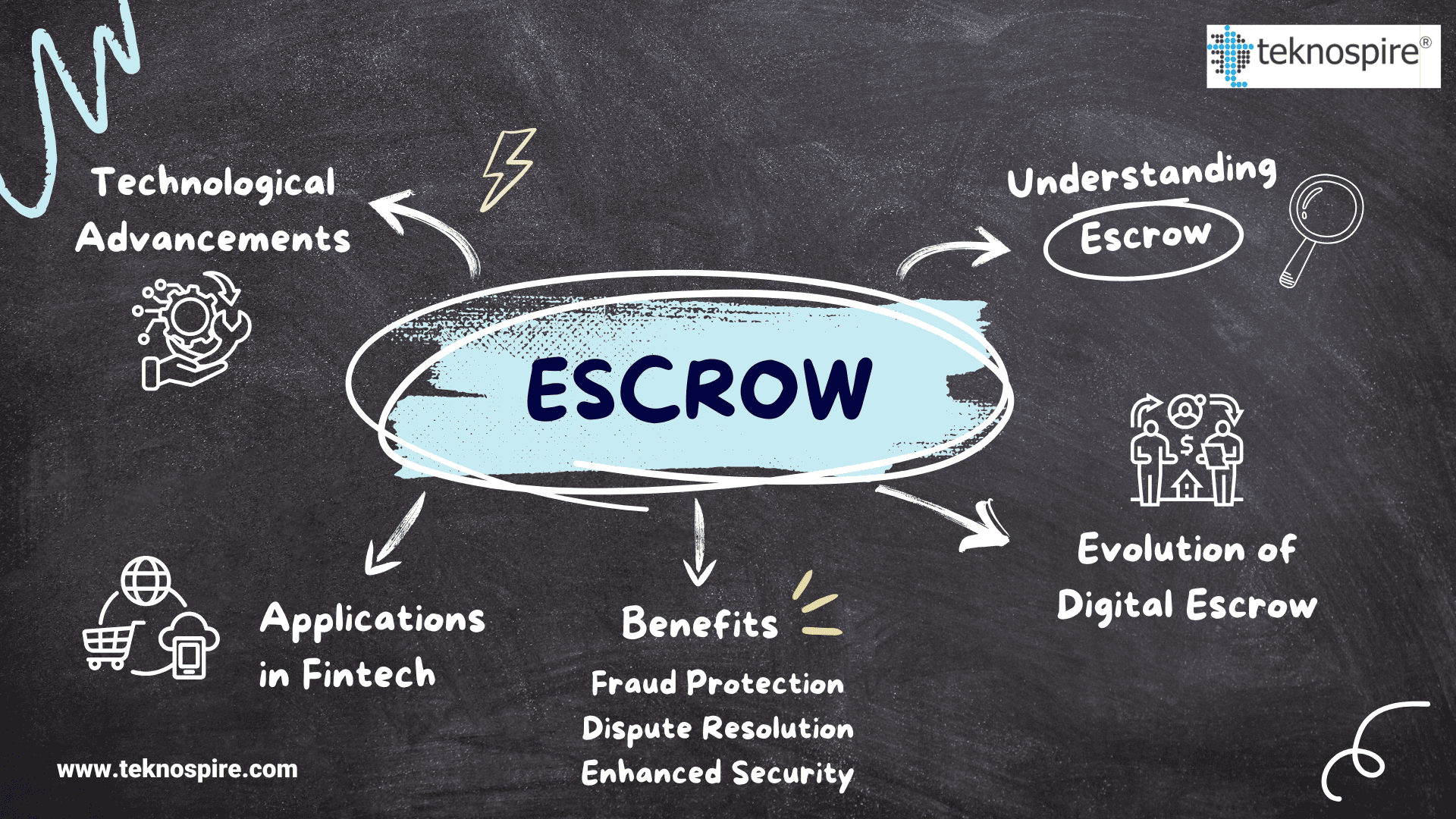

Understanding Escrow

An escrow arrangement involves a neutral third party holding funds or assets on behalf of transacting parties until predetermined conditions are met.

This mechanism safeguards both buyers and sellers, ensuring that funds are only released when all contractual obligations are fulfilled.

The Evolution of Digital Escrow in Fintech

With the rapid advancement of technology, traditional escrow services have evolved into digital platforms, seamlessly integrating into the fintech ecosystem. These digital escrow services offer enhanced security, transparency, and efficiency, making them indispensable in today’s digital economy.

Benefits of Digital Escrow Services

- Fraud Protection: Digital escrow accounts act as a safeguard against monetary fraud, including money laundering and security breaches. By involving an unbiased third party, these accounts ensure that funds are securely held and only released when all agreed-upon conditions are satisfied.

- Dispute Resolution: In the event of disagreements between transacting parties, digital escrow services provide a structured process for dispute resolution, ensuring fair outcomes and maintaining trust in the transaction process.

- Enhanced Security: Funds held in escrow are protected from insolvency of either party due to neutral ownership of funds. This ensures that the transaction proceeds smoothly without the risk of either party defaulting.

- Flexibility: Imagine you’re buying a custom-made product online, like furniture. With digital escrow services, you don’t have to pay the full amount upfront and hope the seller delivers as promised. Instead, the payment can be divided into smaller chunks:

- Milestone Payments: Pay in stages, like a deposit first, then another payment after receiving photos of the finished product, and the final payment once it’s delivered.

- Payment on Inspection: Funds are only released after you’ve inspected the product and confirmed it meets your expectations.

Applications in Fintech

Digital escrow services are particularly beneficial in sectors such as e-commerce, real estate, and online marketplaces, where large sums of money are exchanged, and trust between parties is paramount. For instance, in online auctions involving high-value goods, escrow services ensure that buyers receive the goods as described before funds are released to the seller.

Technological Advancements in Digital Escrow

Digital escrow services are becoming smarter with the help of advanced technologies:

- Blockchain Technology: Think of this as a secure digital ledger that records every step of the transaction, making it transparent and tamper-proof.

- Smart Contracts: These are self-executing agreements written in code. For example, if you’re buying software, the smart contract will automatically release the payment once you’ve received and approved the product.

These technologies remove the need for middlemen, speed up the process, and reduce human errors, making digital escrow services faster, safer, and more reliable for everyone.

Conclusion

Digital escrow services are revolutionizing the way financial transactions are conducted in the fintech industry. By providing a secure, transparent, and efficient means of managing payments, they build trust between parties and facilitate smoother transactions. As technology continues to advance, the role of digital escrow in fintech is set to become even more significant, offering innovative solutions to meet the evolving needs of the digital economy.