While Traditional Banking existed with a prime motive to secure and save money, they never bothered to create a social impact. The Fintech is on the rise, we do see how “Banking is now boosting the social change” with customized and apt solutions and dedicating themselves to improve the lives of people. Fintech industry, on the one hand, is working hard to meet the demand of tech-savvy individuals and on the other trying to serve the underprivileged.

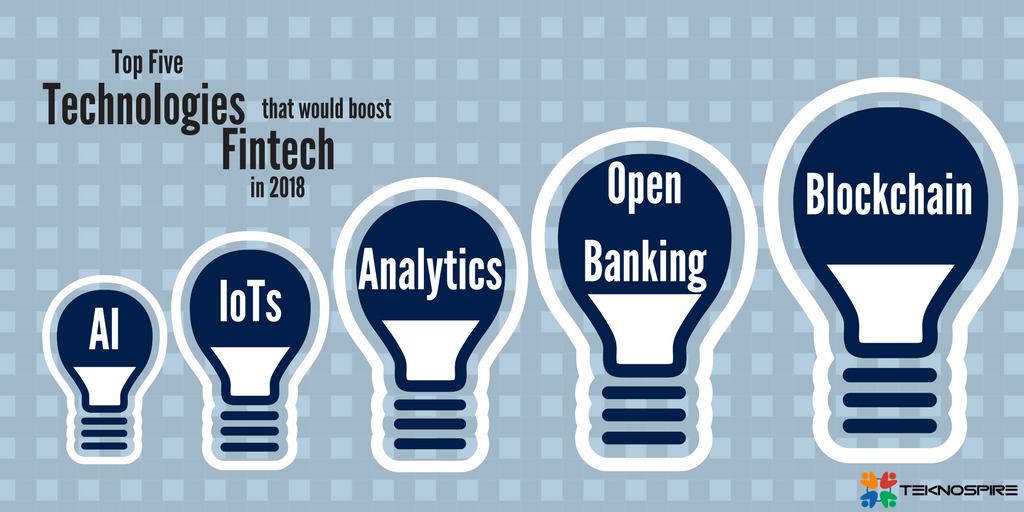

So which technologies would keep the fintech industry occupied this new year? Let’s take a look –

- Blockchain sorting the identities, ownership, and payments

While the buzz is more of bitcoins and cryptocurrency, experts believe its the Blockchain technology that has the potential to disrupt banking and empower inclusion for all. Blockchain a decentralized distributed ledger is spread across many users in a network. Also, known as the trustless network, where authority or regulators do not govern it has been able to serve banking in year 2017.

Blockchain that offers transparency, accountability and efficiency could be used to provide Digital identities, Digital Asset Ownership, Land Ownership and most importantly facilitate mobile payments. According to the Harvard Business Review, it is “likely to do to the financial system and regulation what the internet has done to media companies and advertising firms.” So, while there are firms merely labeling their product as Blockchain when it is just a database, there are firms that are researching, experimenting and implementing the technology for good.

- Open Banking, PSD2, Open API, Open Data – Are your solutions OPEN yet?

Open Banking is no more a tech jargon, with government initiatives like Aadhaar enabled payment system[AEPS] and Unified Payment Interface[UPI] in place we could witness greater innovations happening under this technology. As Deloitte defines –

“Open Banking & PSD2 are both a catalyst and accelerator in this shift towards open services where maintaining flexibility and adaptability will be critical.”

With Open Banking initiative customers could grant data access to third parties that could help them in getting better offers and discounts and better control on the money. While the discussion is on with Open banking offering convenience vs. Control, simplicity vs. security and customized services vs. complexity, 2018 would define who wins the race.

- Augmented Reality, Virtual Reality, Mixed Reality, IoT, Wearable – Disrupting Banking?

Your customer may prefer personalized banking, but how about offering that in his comfortable room/office space? All he needs to do it install an app and use wearables to navigate, be it about the home loan offers or his financial portfolio with AR, VR, MR and wearables it is indeed a possibility.

On the other hand, with IoTs in place, banks could help the farmers by analyzing the yield of crop and could provide them with flexible financing terms. Or the sensors in warehouses could assist the banks in informing when inventory is sold out, and loan needs to be paid back, avoiding false cases.

With an increase in usage of electronic devices that are connected it is easy to track and gather data and helps in boosting inclusion. As per the statements from MasterCard at Money2020-

The future is moving to the Internet of Things and connection makes all the difference between the haves and have-nots, according to recent.

And this “connected real and virtual world” would make a difference in banking for the year 2018.

- Artificial Intelligence – Intuitive, automated and real-time banking

AI the combination of Machine Learning, Cognitive Computing, and Natural Language Processing helps to simulate the intelligence of humans into artificial machines. AI has already been adopted by banks in the form of chatbots, detecting Anti-money laundering [AML] patterns, fraud detection, tailored solutions based on customers interest.

However, in the year 2018 we might see payments/transactions processed via Siri or Alexa, experts could come up with robust algorithms that help traders manages their risk and portfolio and most importantly many back-end processes would be automated, thanks to Robotic Process automation [RPA] evolution.

- Data Science, Data Analytics – Let the data do the talking

Each day data is growing, however, to make sense of this data we need analytics. The data science is not just about a bar graph depicting an individual’s spending’s, its way beyond. How could a bank decide the value of cash needed at an ATM? Or how about a payment bank [also serviced via kiosks] know which agent has been making high sales? Or whether the discounts offered on credit cards are being used?

Many of such queries have been answered in the past via Analytics, but combined with the power of Artificial intelligence, cloud computing and IoT these decisions now could be real-time and strategies could be altered at run-time giving a hard run to your competitors….

References:

Post Views - 47