The post first appeared on Linkedin. To get more such insights, please connect with me here.

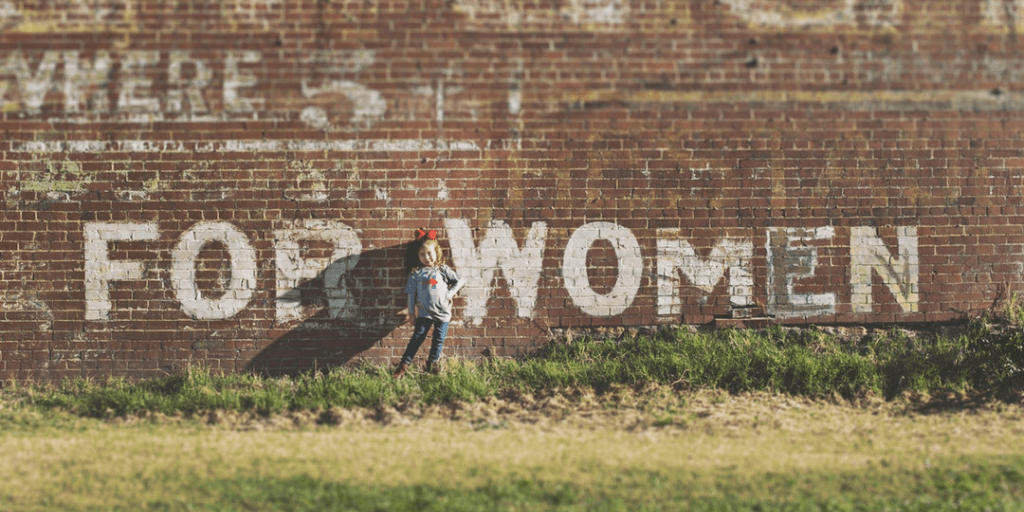

My last post on LinkedIn spoke about “extra push” from government, brands, banks, and technology. While these are guiding lights of the Financial Inclusion game, the torch-bearing initiators in each household are women. Women the changemakers of the society, it’s worth mentioning the famous quote from Erick S Gray –

Whatever you give a woman, she will make greater. If you give her sperm, she’ll give you a baby.. If you give her a house, she’ll give you a home. If you give her groceries, she’ll give you a meal. If you give her a smile, she’ll give you her heart. She multiplies and enlarges what is given to her. So, if you give her any crap, be ready to receive a ton of shit!”

Indeed, women who take care of savings, child’s education, an extra hand to earn if she is included in financial and social inclusion, can involve a home. That’s the power of WOMEN!

However, what sounds so ideal is not entirely true!

Women in Financial Pyramid

A look at the different surveys conducted talking about involvement in financial planning, decisions, and discussion –

A survey conducted by Apollo Munich Health Insurance in collaboration with AC Nielsen found that Indian women still viewed as supplementary bread earners

According to the World Bank’s Global Findex Database 2017, in developing economies female account owners are, on average, five percentage points more likely than male account owners to have an inactive account. In India, however, this gender gap is about twice as large, says the report, adding that 54 percent of women with an account made no deposit or withdrawal in a year as compared to 43 percent of men.

An estimated $300 billion credit shortfall for women-owned micro-, small-, and medium-sized enterprises in emerging economies, and women are also more likely to be dissatisfied with banking services worldwide.

While you may not believe these surveys, look around you – your home, extended family, friends, community helpers, female colleagues where do you see “women” in the financial pyramid? Also, did you notice they have the power to drive the financial discussion, and that’s the key to Financial Inclusion.

Bridging the gap of Financial Inclusion with Women

We just realized the power of WOMEN, but how do we harness it?

Start small

Start with your housekeeping or house helper at home, educate them with the power of Digital Banking. Offer them to pay salary via digital means, help them and show them how 100 rs in a bank for three months can earn them interest. Government and banks are advocating and offering a zero-balance account for all.

Take it to the next step, availing of mobile banking for funds transfer to their native place or assisting them with a loan for child’s education. Ask her to involve her neighbors and friends.

Be the Guiding Light

A famous quote says it all – if you want a change, be the change.

Could you be the guiding light connecting the grass root individuals to government initiatives or banks? One of the famous example I could quote is Mrs. Chetana Sinha Ji of Mann Deshi Foundation a social activist working rigorously to empower women. She has worked at the grass root level to provide banking services exclusively to a bank with her initiative Manndeshi Bank. In one of the interviews with Teknospire, she quoted about her experience of starting Manndeshi bank. She shares, one of the women came to her asking – I just have 5rs, would bank allow me to open an account?

Would you be the guiding light for many such people?

Banks expanding and empowering women

Banks need business opportunities, new customers and always look for expansion. Targeting the “female segment” could help them gain more business, and this could be done at reduced CAPEX. Just for example a bank looking for opening a branch can opt for a digital banking solution via “mobile” or gather “agents as entrepreneurs” to launch Agent Banking to a new area.

If you are willing to be a guiding light or a bank expanding the digital services, we are here for you.

Teknospire a fintech firm offers Bank-in-a-box solution with omnichannel, agent/digital branches capability. The 360-degree banking solution reduces the CAPEX for a bank to set up a physical branch, but yet opens doors to expand their business. Our Digital Banking, Mobile Banking, and Agent Banking solution could help regional banks and cooperative banks to push Financial Inclusion further. For details, please contact us here

Watch out this space to get more insights on Last Mile Banking or Financial Inclusion.