Fintech Tools Enabling BaaS to Remote Areas

Cashless Payments, Digital Economy, Financial Inclusion these buzzwords seem to be the modernized face of banks and fintech industry. The urban class may be reaping its benefits, but what about the rural people? The lower income group is not competent to get a designer financial portfolio for himself. He has basic demands like – Cash Security, Anytime Cash, Hassle free loan, financial literacy and budget management. So, could the fintech tools and technology serve the purpose? Let’s dive in to find out :–

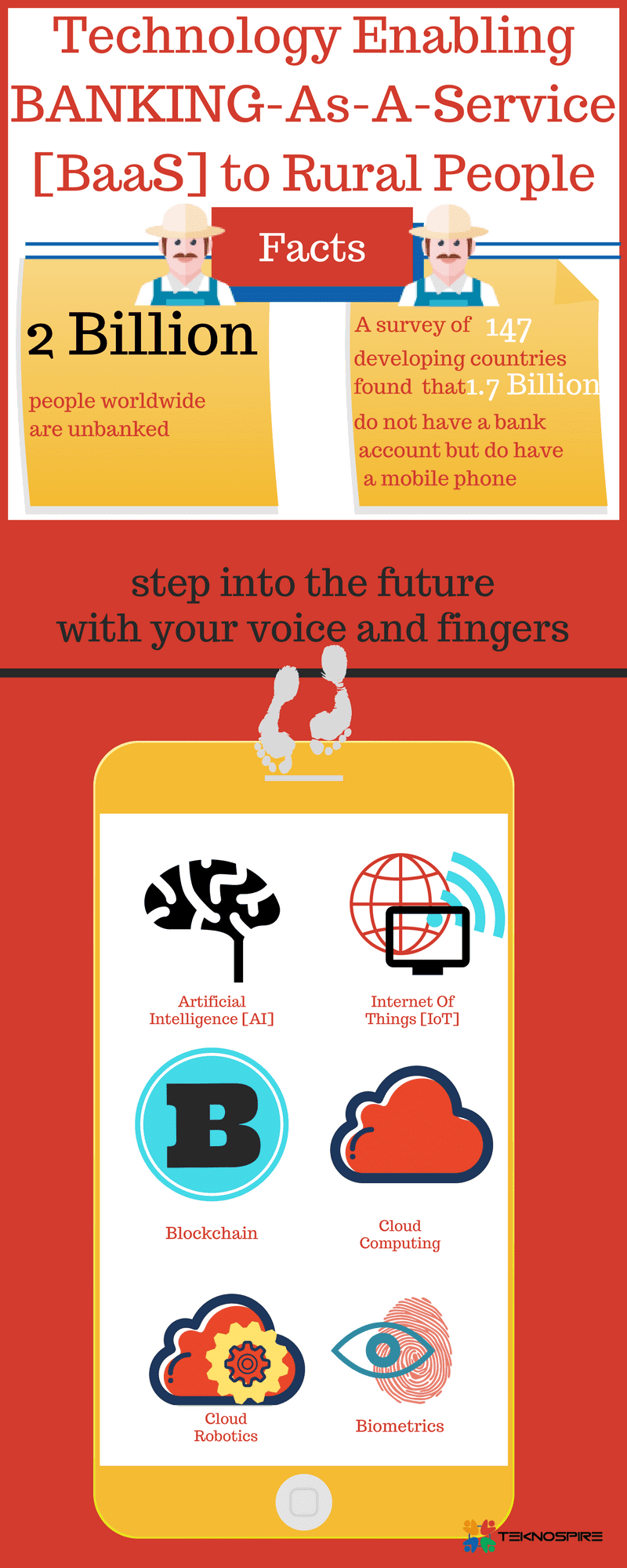

Fintech Tools and Technology That Could Enable BANKING-As-A-Service [BaaS] to Rural People

Experts believe that technologies like Artificial Intelligence, Blockchain, Internet of things, Cloud Computing, Cloud Robotics, Automation, Biometrics and Quantum Mechanics would change how we tackle our daily chores and services.

Let’s take a closer look at these advanced technologies that could shape the Fintech Scenario of remote villager’s life. –

Knowing the fact that the unbanked population could also be uneducated and could only converse in the local language, the agent banking has been flourishing. But how about an AI-based app that could help you provide answers to all your banking needs via voice? Simple queries like – What’s my savings account balance or Transfer funds to my kid school account would not only help rural people use the banking services but would also make human involvement redundant.

Above was one of the quick example of voice – assisted payments that could use Artificial Intelligence, but it could also help in remote workers to locate the nearest ATM or cash counter to collect money in case of emergency.

In India AnyTimeLoan – a start-up from Hyderabad is providing a shorter term unsecured loan to “needy people.” Loans for amount 1,000 – 60,000 INR are given for shorter duration i.e. 1- 90 days. They also disperse loans to students specifically for K-12 students to support their educational needs.

Another fintech firm – MyBucks in Luxembourg is bridging the gap of traditional and virtual banking. Backed up with the power of technology they are offering financial products and extending their help in creating financial inclusion.

Wallet.AI the smart wallet monitors users behaviours and spending habits, and then alerts and educate individuals on how to increase saving while making some intelligent spending decisions.

Blockchain with its unique characteristics provides financial institutions and fintech firms for modifying their products and services leading to the adoption of services by unbanked and underbanked.

In India one of the leading banks State Bank of India has announced new initiative Bankchain, that would allow data exchange across banks thereby reducing fraud and duplication.

Coins.ph a firm from the Philippines has built a mobile based app that uses Blockchain and allows users to buy load, pay bills, send and receive money, and shop online in more affordable and faster manner. Another Nairobi-based fintech firm – BitPesa is offering global money transfer to pan-Africa via Blockchain platform. The firm receives the funds in the original currency, that is then transferred to the digital currency. This digital currency is then transferred to the closest real time digital wallet via Blockchain in the destination country. Finally, it is converted into its local form and paid out.

Smart Homes and wearable devices are some of the examples urban population is exposed to, that uses Internet of Things. But to help the needy with basic facilities like water, electricity and data, firms are brainstorming new ideas and are also implementing them successfully. Firms in Africa who are using solar power to provide electricity to the underprivileged group have recently partnered with a digital wallet firm to facilitate services like Pay-as-you-go and prepaid. So, while Solar lanterns could be bought, you could easily recharge them with your digital wallet and get electricity on the go.

While Fintech would explore getting banking to the doorstep, Insurtech could take into accounts the living conditions and present a customized insurance plan. Or how about a farmer whose harvester machine sensors convey about the condition to its service center and in case it needs repair it could be scheduled before harvesting season.

With data stored and accessed via Cloud, it offers benefits in cost reduction and anytime anywhere access. Most of the digital wallets across the world are using the power of cloud computing and providing banking to rural people.

Some of the leading banks in India like ICICI Bank, HDFC Bank have started using cloud technology to boost the financial health of the economy.

Integration of Cloud computing with Robotics is serving the population with time-saving and higher quality offerings. Cloud Robotics Banking could allow the natural flow of data backed up with e-KYC making account opening smooth and hassle free.

In India, ICICI Bank has launched Smart Vault. It is an excellent, first-of-its-kind locker in India that is designed to bring human intervention to a minimum. Smart Vault is a progressive breakthrough in the way banking technology is being implemented in the country. Users can access their locker at any time of the day or night and even on bank holidays. Powered with robust multi-level security measures, it utilizes a robotic arm to fetch your locker from a secure vault using Radio Frequency Identification (RFID).

Biometric technology like fingerprint and iris scanner are making banking services accessible to many first-time users. Bharat Financial Inclusion earlier known as SKS Microfinance Ltd is providing collateral-free loans to individuals, especially women to allow them to set-up their business/income generating activities.

The Indian Aadhaar based biometric authentication is enabling users to avail loans instantly. Fingpay a product based startup from Indore is using Aadhaar ID and biometric authentication to allow merchants process digital payments from individuals who do not have a credit card or digital wallet.

While digital channels and fintech tool could design policies to enhance inclusion and remove barriers by mitigating risks and identifying frauds they also need to come with responsible regulations to serve the needy.