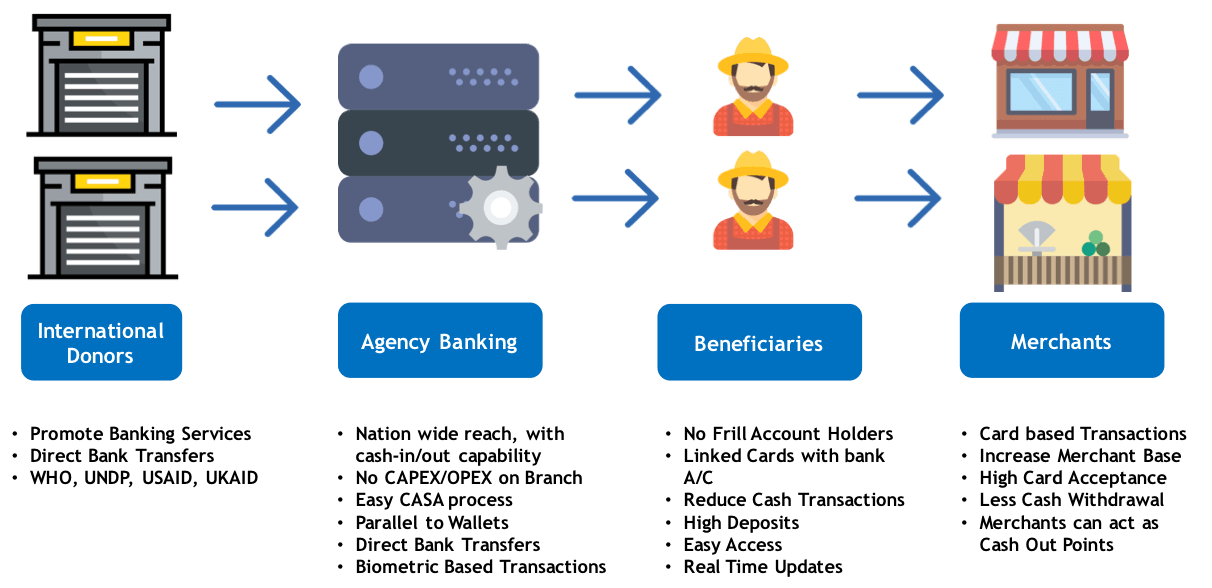

The above diagram represents the role that Agency Banking, powered by FinX, is playing to create a cohesive ecosystem connecting the farmers with the suppliers, buyers, merchants, financial institutions, international organizations like WHO, UNDP, USAID etc.

This article explains the problem statement that most of the International Donors like UNDP, WHO, USAID are facing in #africa for #grantdistribution to the last mile population and how #Teknospire is helping bringing #fintech #disruption to solve the overall problem.

Africa: International Organizations are infusing grants ranging in millions of dollars every year, in developing and under-developing economies to uplift the bottom of the pyramid population and paddle up the social-economic boost. Distribution of funds to the right set of beneficiary is one of the major problem at the ground. These grants are expected to be spent on establishing/enabling small businesses, small and medium manufacturing units, establish health centers, medical aids, education fee and many more small but important set of activities with the objective of pumping the bottom of the pyramid population to become the part of the formal economy. The Distribution takes place by awarding the contract to local agencies like NGOs, Security Companies etc. Predominantly, the fund distribution works as simple cash handover against some in-secured unique identity with weak Beneficiary Authentication.

Why this is Cash and not Digital?

- Basic Banking Service itself is costly, because, the cost of procuring and maintaining the technology platforms to run the banks are costly.

- Financial Institutions like Banks are happy to focus on the top layer who are generally Large and Medium Corporate houses (low number of high value transactions).

- Mobile Wallet Operators focussed on serving and acquiring the bottom of the pyramid population, which they got successful at first place and they opened a parallel economy (high number of low value transactions) as the major achievement, competing and giving hard time to the Financial Institutions. Since they have invested millions of benjamin franklin in positioning their wallets in the market and people being left with no choice except their financial product, now is the payback time and thus fees for cash outs, transfers and transfers have increased multiple times. For example, to receive $20, the receiver might end up getting only $15 while $5 could be the various fees charged to them.

Hence, the receivers are happy to stick themselves on Cash.

The second problem that arises is to trace the consumption points of this cash. Approximately 60%-70% of the distributed transaction value is not utilized for the purpose for which it was distributed, and this is where the gap of tracing the end-to-end journey of this cash becomes a problem statement.

What could be the possible solutions?

- Financial Institutions like Banks should gear up themselves to think on their relaunch with a new avatar by leveraging on futuristic technologies brought by FinTech players like @Teknospire.

- Low cost, customer centric financial products to be innovated and brought-in, to get an upper hand against the strong wallet players.

- Work towards creating a smooth digital value chain by connecting all the legs.

With the FinX – Agency & Payments Banking System, the financial institutions can tap on this gap by taking the basic banking services to these beneficiaries by offering them low cost banking products and get the digital value chain created from the deposits. This then can enable the financial institution to innovate other products around lending, equities, securities etc.

The cash driven society can then be transformed to Cashless society with digital payments happening at all the legs.

Originally Published in LinkedIn:

Enabling Basic Banking Services to Beneficiaries of International Grants