While, as a technology provider firm we always urge our clients’ Banks and FI’s to adopt “Digital Channels,” we also stress on How to evaluate the ROI of a Digital Bank after implementing the banking solution.

Here is a quick guide that would guide you to look for KPI’s and calculate the ROI of a Digital Bank –

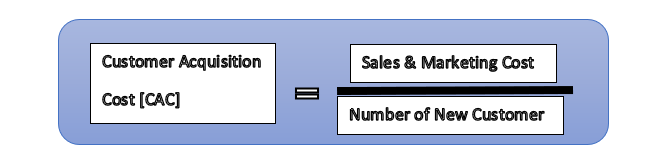

KPI 1 – Cost to Acquire a Digital Customer [CAC]

If you have purchased a core banking solution, hired a team of development, sales, and marketing, you should know at what cost are you able to acquire a customer? CAC helps you in that, and it can be calculated as follows –

KPI 2 – Digital traction metrics

Digital traction metrics apply to any digital platform that offers digital products and services. It audits a digital strategy, whether it helped in attaining a positive ROI.

For a Banking vertical, a user could set up KPI’s digital –

- Number of Visitors

- Number of Registered users on mobile app and web interface

- Growth in registrations month-on-month

- Growth is Daily Active Users

- Increase in Monthly Active Users

- Conversion Rates

- Abandon Rates

KPI 3 – Lifetime value of a typical customer (LTV)

Do you know when compared with other verticals, Banks have an added advantage of holding their customers for a more extended period? So once a customer signs up on your banking platform, the chances of him to stay are bit longer when compared to other domains like Fashion or hyperlocals. And that serves as another KPI to measure your Digital banking performance.

LTV that is also known as lifetime customer value (LCV) or customer lifetime value (CLV) is a forecasting tool that estimates the projected revenue a client could bring in over the lifetime of his relationship with your business. It serves as an essential factor for Banks in planning and allocating revenues for retention and engagement.

KPI 4 – Innovation and Expansion

You might be successful in getting a user onboard with a banking account or loan account, but what next? Hence it is crucial to define a KPI that measures innovation in financial products and helps you in expanding your customer reach to other products.

So for example, if a customer is making a fund transfer, putting a banner that says he could avail an offer on grocery shopping or he can book travel insurance on the same portal helps in expanding the services.

You need to allocate some budget to this and also measure on a defined period say quarter, how many sign-up for a service or offer.

A more detailed post on this was published early this year, and you can access it here.

We are a technology provider for Banks and NBFC’s keen on offering solutions that earn a positive ROI. If you are looking for one, we are just a call away.