We might have heard many such quotes from our leaders, but what has been the ground reality? Has the government made any progress? What were the initiatives taken to boost social and financial inclusion? Demonetization? GST? MadeInIndia? JanDhanYojna Or DigitalIndia? Let’s dig in to explore –

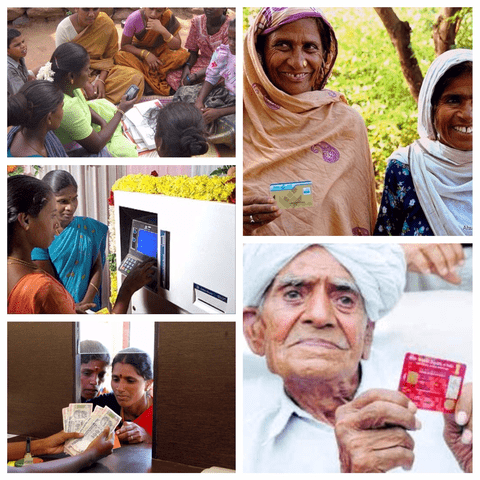

Images Source – Collage

What is the Scope of Financial Inclusion?

What all services could you think that needs to be included in Financial Inclusion? Deposits? Funds Transfer? Loans? While we do not have an official information on what all services need to be included in Financial Inclusion, but here are the basic banking services that could enable Social and Financial Inclusion –

Challenges in Enabling Financial Inclusion in India

India is the land of villages and farming, yet banks and banking haven’t reached around 19% of Indian population. Few of the challenges faced by Institutions, NGO’s, Fintech firms are –

Initiatives by GOI to Enable Social and Financial Inclusion

One of the primary and significant schemes that allow individuals to open a bank account, basic banking no-frills account with nil/very low minimum balance as well as charges.

GOI launched Pradhan Mantri Suraksha Bima Yojana (Accident Insurance), Atal Pension Yojana (Unorganized Sector) and Pradhan Mantri Jeevan Jyoti Yojana (Life Insurance), to enable social and economic security to the underprivileged sections of the society.

Micro Units Development and Refinance Agency Bank (MUDRA Bank), launched in April 2015 provides loans at a low rate to enable enterprise for founders on rural/remote areas.

Another scheme initiated by GOI, each branch of public sector banks need to support one entrepreneur from Women and minority society.

As we are witnessing LPG subsidies now getting credited directly to your accounts, on similar lines through Pahal Scheme GOI is keen to transfer grants and funds directly to beneficiaries account, removing the middle layer.

MFC that provide micro loans to farmers, stall owners, women’s help in structuring the financial loan service and helping people from the money lenders debt trap.

As cleartax defines Goods & Services Tax Law in India is a comprehensive, multi-stage, destination-based tax that will be levied on every value addition. GST also brings in the benefits of enabling financial inclusion by –

With the ease of technology and availability of mobile phones – solutions like Agent banking are enabling financial inclusion in the remotest areas of the developing countries like India, Bangladesh, and Zimbabwe.

GCC allows the holder with a credit facility of up to 25,000 in rural and semi-urban bank branches. The primary objective of this scheme is to provide instant and hassle-free credit to its customers.

How Teknospire a fintech firm is enabling Financial Inclusion in India

Teknospire with its tagline Inspiring technologies for better living is a proud contributor to help in financial Inclusion. With its range of Fintech and HealthTech solutions to provide secure Agent Banking or Mobile Money suite or to credit grants to beneficiaries account , Teknospire is making it possible.

GOI is putting extra efforts to bring the change, however firms like Teknospire are adding value to these plans and making execution a possibility with our skilled team and latest technology.

The financial architecture in place thanks to GOI; we have the solutions utilizing the latest technology thanks to firms like Teknospire , however what is missing is the bridge to connect them. The cooperative banks, NGO’s, microfinancing firms and many more such channels who could adopt to these simple solutions providing banking to all. It’s a matter of putting in more speed, efficiency and time to make Banking a fundamental right to every individual.

Image References:

Blogspot

HansIndia

IFMR

IFMR

CGAP

IIMB

References:

Initiatives undertaken by the NDA Govt

Lets grow with MUDRA Loan- MUDRA Bank

Micro Units Development and Refinance Agency Bank

The Innovative Financial Inclusion Schemes Of The Modi Government

What are the latest initiatives in achieving financial inclusion by the government of India?

Financial inclusion

GST for all: Converting the unbanked

What are the good sides and the bad sides of GST (goods and services tax)?

GST : What is the impact of GST on the common man ?

GST: IMPACT ON THE POOR

GST Benefits – Advantages of Goods and Services Tax Bill in India

An Insight of GST in India

A Research Paper on an Impact of Goods and Service Tax (GST) on Indian Economy