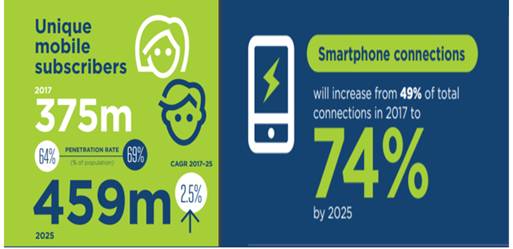

The Middle East and North Africa are witnessing a change in consumer preferences, evolving Fintech start-ups, and supporting regulation are testing banks and FI’s digital capabilities. The consumers are going digital, creating new opportunities for financial market to disrupt and embrace fully integrated mobile wallets via smartphones, wearables, and tablets. A recent GSMA research outline that in 2017 MENA region had 375m unique mobile subscribers that could reach to 459m by 2025, where smartphone connections can increase from 49% to 74% by 2025. In fact in countries like UAE the mobile phone usage is nearly 100%.

To such a rapidly growing market, how can banks and financial institutions offer the best-in-class mobile payment experience? Our post of today will help you with that.

The Mobile Wallet Use Cases in MENA

While you may find a digital wallet as a technology buzzword, let us understand what customers are willing to use their mobile money for?

Avail Banking

Consumers in the MENA region are willing to use Mobile wallet to avail services like –

- Opening a Bank account

- Apply for Loan

- Apply for Credit Card

- Get product advice

- Apply for savings/Fixed deposit

- Balance Enquiry

- Funds Transfer

Where can Banks and FI’s improve?

While adoption to less complicated services like balance inquiry and funds transfer could be achieved, opening a bank account, getting a loan and credit card is where the customer finds absence of “end-to-end digital workflow” with a sense of trust and security.

Avail Loyalty Programs and Discounts

E-Wallets attract a lot of consumers for the loyalty programs, cashbacks, and discounts offered. For a bank or FI digitization of banking services like debts, personal finances and investment make more sense, but customer looks for their banks to provide more than banking in shopping, paying bills and book tickets.

Some of the features that a mobile wallet user may be interested in –

- Attractive loyalty programs

- Discount coupons

- Mobile payment for cabs and neighborhood shops

- Virtual prepaid card for secure payments

- Customized bill payments

- A personal advisor or relationship manager

- Message-based payments

- Apply Personal loan, credit card, and mortgage via mobile

Where can Banks and FI’s improve?

Major gap for consumers is in understanding the products and services, the UI is not friendly, and in case they face any glitch they are again asked to contact customer support, making it a partial digital experience. If banks and FI’s could improve on availability, Security and awareness of digital solutions to its consumers offering them easy-to-use, seamless and end to end digital solutions it would help them in gaining trust of consumers.

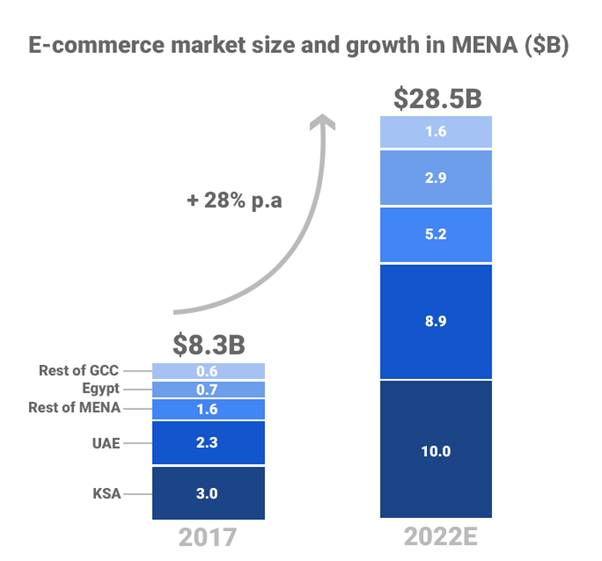

E-commerce is the future

In 2017, e-commerce in MENA touched $8.3 billion, i.e., with an annual growth rate of 25%. As forecasted, this figure is expected to reach $28.5bn by 2022. UAE, the most tech-savvy country in MENA region has a penetration rate of 4.2%, while Saudi Arabia is close to UAE with 3.8% penetration, combining both sector accounts for 60% of e-commerce market.

Where can Banks and FI’s improve?

Consumers are looking for convenienceand security aspects while making an e-commerce transaction. Banks and FI need to work on their integration with channel partners. Offering a mobile wallet as one of the payment options to consumers of their favorite brand can help in winning the race for long term.

Target Cross Border Remittance

As per a report of 2015 latest data on international migration stocks, 34.5 million international migrants, that includes registered refugees are residing in the MENA region. Another report of March 2017 stats – 4.9 million Syrian refugees in the MENA region. Also, the conflicts in Iraq and the Republic of Yemen have led to internal displacements. According to the United Nations High Commissioner Lebanon and Jordan hosted the highest number of refugees worldwide in relation to their population size in 2015.

Also, what is worth noting is the cost of remittance of sending $200 in the MENA region is 7.4 percent in 2017. If we could simplify remittance cost clubbed with making it simple and hassle-free, many migrants in MENA could be thankful to Banks and FI’s.

Where can Banks and FI’s improve?

Banks and FI need to bridge the gap of offering the remittance solution with help from regulation. What Banks needs to understand is that “the untapped population” in the form of migrants could be their customers and if they are onboard with a simple Account opening service followed by a mobile remittance solution you not only have earned a customer but also enabled financial inclusion.

Target Electronics, Fashion, Beauty in Ecommerce

If we have to rate consumer choice of shopping category on an e-commerce platform, the top-rated one is electronics, followed by Fashion and Beauty and least [or a very smaller section] prefers shopping grocery online. As quoted in one of the articles on thinkwithgoogle.

Pushing Mobile wallets to these brand lovers’ shoppers could help you in generating revenues. While consumers would enjoy benefits of anywhere anytime shopping, they could also reap benefits of discounts and cashback.

Where can Banks and FI’s improve?

Tap into the in-house data, analyze customer’s preferred choice of category, credit behavior, and offer a personalized product. As a consumer one of the pain point they face regularly is looking for best payment option while going shopping on an eCommerce platform. Pitching them with personalized shopping advice could help banks in cross-selling and drive revenues.

Banking has to evolve

The consumer no longer needs just a bank; they need a solution that could help them in solving their education loan issue, help them in shopping, book tickets for the vacation. Hence even Banks need to evolve and come out of the silo of offering just banking.

Customers in the MENA region are tech-savvy who visit an eCommerce platform via search and video. As per stats on an average 70% of people in UAE and Saudi Arabia engage in shopping-related search queries on their smartphone. Another research on women in KSA suggests that Youtube has introduced 50% of shoppers to a new brand.

For serving such a customized consumer, Banks need to evolve their offerings and products.

Where can Banks and FI’s improve?

Get involved in digital marketing, content marketing, digital customer lifestyle management to succeed. Merely copying the manual process into a digitized form may not help, adapt to the design thinking process to understand customer needs and offer “the right fit” product to your customer. Just for example if a consumer in UAE was browsing a brand ABC, offering a cashback/coupon on the brand or the store would help you in winning his heart.

All of this can be offered by a customized lightweight solution – Mobile Wallet. It serves all individuals – whether they are tech-savvy or migrants. A wallet that could enable –

- Banking

- Shopping

- Offers

- Remittance

- Bill Payment’s

- Customer-centric

- Analytics-driven

- End to end digital

- Seamless branch experience

If you are looking to launch a mobile financial service/mobile wallet within the MENA region, we can assist you. We are well-equipped with the latest technology, and our keen research on MENA market would help you in positioning your wallet at a star position. Just give us a call.