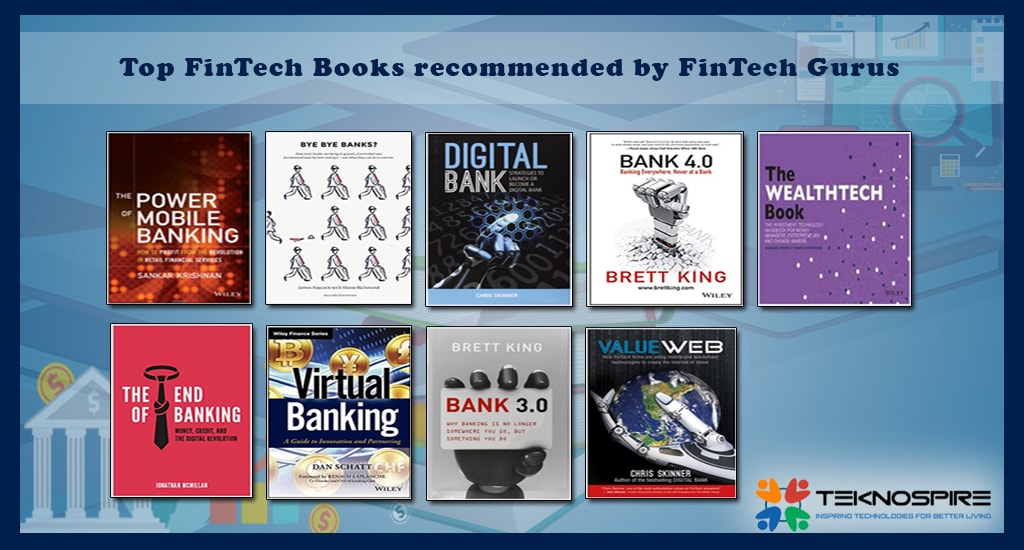

The value of FinTech investments globally in 2008 was 1 billion USD, which rose to 10 billion USD by 2014 and is projected to touch 46 billion USD by 2020. So much is happening around FinTech but how much you know about FinTech is the question. Are you in touch with ‘How the latest development in FinTech can impact your daily routine?’. Strongly recommended by the top shots in the FinTech industry, these FinTech books hold the key to many of your answers. Happy Exploring!

- Digital Bank

To know about innovations happening in banking and how Mobile Banking is transforming the way consumers interact with the banking industry, “Digital Bank” by Chris Skinner is a must-read book.Chris Skinner is one of the most influential people in banking whose works have earned him the sobriquet “Fintech Titan”. He has not only guided the readers in an exhaustive way about the digital revolution but also depicted the way existing banks like Barclays in the UK, start-ups like Metro Bank and disruptive formats like FIDOR Bank, have focused on modern technologies, in redefining the banking sector.

To know about innovations happening in banking and how Mobile Banking is transforming the way consumers interact with the banking industry, “Digital Bank” by Chris Skinner is a must-read book.Chris Skinner is one of the most influential people in banking whose works have earned him the sobriquet “Fintech Titan”. He has not only guided the readers in an exhaustive way about the digital revolution but also depicted the way existing banks like Barclays in the UK, start-ups like Metro Bank and disruptive formats like FIDOR Bank, have focused on modern technologies, in redefining the banking sector.

Strongly recommended by Seth Wheeler, former Special Assistant to the President for Economic Policy at the White House, City AM and The Financial Brand, it is a must-read for all, be it a professional, a banker or a Fintech enthusiast. Digital Bank signifies the need for digitalization of banks. Chris justifies his status as an independent commentator on the financial markets and Fintech.

- ValueWeb

Chris Skinner has masterfully illustrated the complexity of the Internet of things and Internet of value in his book ‘ValueWeb’. He has thoughtfully used the resolutions which were utilized by Fintech companies to solve the problems faced by the old systems by collaborating “Internet of Things” and “Internet of Value”.Skinner, who chairs the European Networking Forum- The Financial Services club, highlights the convergence of technology, e-commerce, and finance which are being combined by them to build the ValueWeb.

Chris Skinner has masterfully illustrated the complexity of the Internet of things and Internet of value in his book ‘ValueWeb’. He has thoughtfully used the resolutions which were utilized by Fintech companies to solve the problems faced by the old systems by collaborating “Internet of Things” and “Internet of Value”.Skinner, who chairs the European Networking Forum- The Financial Services club, highlights the convergence of technology, e-commerce, and finance which are being combined by them to build the ValueWeb.

Backed by the likes of Seth Wheeler, former Special Assistant to the President for Economic Policy at the White House, business-focused newspaper City AM and The Financial Brand, this book covers how ValueWeb permits machines to trade with machines and people with people across geographical boundaries in real-time with speed, precision and with zero cost.

This well-researched book is of great interest to people curious to get a glimpse of the future of FinTech.

- The Power of Mobile Banking

‘The Power of Mobile Banking’ is a combination of guide and tutorial to banking professionals on how they will face competition from telecoms, E-Commerce retailers, and technology companies.Sankar Krishnan, having more than 25 years of experience in banking and financial services, strongly suggests the traditional bankers that ‘Mobile Banking’ and the ‘Internet of Things’ are the things of today.

‘The Power of Mobile Banking’ is a combination of guide and tutorial to banking professionals on how they will face competition from telecoms, E-Commerce retailers, and technology companies.Sankar Krishnan, having more than 25 years of experience in banking and financial services, strongly suggests the traditional bankers that ‘Mobile Banking’ and the ‘Internet of Things’ are the things of today.

Banks need to streamline themselves to deliver the populous demands of personalized banking experience via Mobile Banking.

In addition to rendering strategies for adapting to Mobile Banking to benefit customer and revenue, he has taken a step further by covering the risks, hazards, and wealth opportunities which lay with Mobile Banking.

Recommended by Parameter Insights and Fintech News to name a few, it is a must-read book for bankers and professionals, especially associated with traditional banks.

- Bank 3.0

A renowned futurist, keynote speaker and four-time bestselling author- Brett King released his first book “Bank 2.0” which was a bestseller on Amazon in the US, UK, Germany, France, and Japan.Followed by this, he wrote “Bank 3.0: Why Banking is no longer somewhere you go, but something you do”. It focuses more on financial services and payments like the widespread use of Mobile Wallet and also talks about the impact of social media on the banking ecosystem.

A renowned futurist, keynote speaker and four-time bestselling author- Brett King released his first book “Bank 2.0” which was a bestseller on Amazon in the US, UK, Germany, France, and Japan.Followed by this, he wrote “Bank 3.0: Why Banking is no longer somewhere you go, but something you do”. It focuses more on financial services and payments like the widespread use of Mobile Wallet and also talks about the impact of social media on the banking ecosystem.

The book illustrates more on the perspective formed by tablet computing to the operational engagement of the cloud.

Brett has elaborated on how FinTech has created a community which includes de-banked customers, who don’t need a bank at all.

He shows that FinTech companies can leverage the opportunities created by the gap between customers and financial services players. No wonder it got likes and extensive coverage in Fintech News.

- Bank 4.0

Highly recommended by FinTech News, this masterpiece by Brett King is next in the series after ‘Bank 2.0′ and ‘Bank 3.0′.The best-selling author, in ‘BANK 4.0: Banking Everywhere, Never at a Bank’, envisages what banking might come to look like in the coming decades as he portrays his vision of the future of banking in the next 30-50 years time.

Highly recommended by FinTech News, this masterpiece by Brett King is next in the series after ‘Bank 2.0′ and ‘Bank 3.0′.The best-selling author, in ‘BANK 4.0: Banking Everywhere, Never at a Bank’, envisages what banking might come to look like in the coming decades as he portrays his vision of the future of banking in the next 30-50 years time.

He discusses how cash, cards, and the conventional banking ecosystem will be redesigned. Snippets of his vision of what banking will become include a completely transformed banking ecosystem where ‘Selfie-pay’ will work in China, ‘blockchain’ will exist in Africa, and ‘self-driven cars’ will have their own bank accounts.

King continued that the best investment advice is coming from algorithms and robo-advisors that can adapt your portfolio in real-time as markets shift.

“The banking system of tomorrow is being built from first principles today and most banks won’t survive to see that future banking system.”, claimed King.

- The WealthTech Book

The book gives you an in-depth insight into the digital revolution that has happened over the years. It can be an excellent guide for entrepreneurs, investors, innovators, analysts, and consultants.Authors, Susanne Chishti and Thomas Puschmann have focused on the “Wealth Management Sector” and the impact of technology on it.

The book gives you an in-depth insight into the digital revolution that has happened over the years. It can be an excellent guide for entrepreneurs, investors, innovators, analysts, and consultants.Authors, Susanne Chishti and Thomas Puschmann have focused on the “Wealth Management Sector” and the impact of technology on it.

Susanne Chishti, CEO of ‘Fintech Circle’, founded Europe’s first ‘Angel Network’ focused on Fintech opportunities and Fintech Tours. She and Thomas have successfully guided investors by explaining how investors can achieve better returns on their investments in FinTech.

In this book, they have explored how technology and start-ups can influence disruption in order to enhance customer satisfaction. Greatly mentioned by FinTech News, the book contains motivational success stories, business models and exhaustive detailing of market dynamics.

- Bye Bye Banks?

In ‘Bye Bye Banks?’ author James Haycock, Founder, and Managing Director of Adaptive Lab, along with Shane Richmond have given a clear message on the “Banking Business Model” to top executives of incumbent banks.A very bold and timely analysis with a strong message: ‘Adapt or Prepare to be Disrupted’.

In ‘Bye Bye Banks?’ author James Haycock, Founder, and Managing Director of Adaptive Lab, along with Shane Richmond have given a clear message on the “Banking Business Model” to top executives of incumbent banks.A very bold and timely analysis with a strong message: ‘Adapt or Prepare to be Disrupted’.

The book depicts the future of banks and how retail banking business is shaping up along with the digital transformation. Elaborating the way start-ups are using opportunities and technology to siege the market, they have forewarned the banks that if they do not adapt to the changes happening around them they should prepare themselves for imminent displacement.

Haycock and Richmond conclude with the recommendation that traditional banks need to reinvent themselves by launching a ‘Beta Bank’: a lean, stand-alone organization fit for the future, for which they provide a ten-point operating model.

Backed by the likes of Fintech News, Parameter Insights and Alessandro Hatami, former Innovation Executive at Lloyds Banking Group, who beautifully summarizes it, and I quote,

“This work accurately and concisely captures the effects of the disruption brought to the banking industry by the digital revolution. The comments by other banking and innovation professionals about their own experiences are particularly intriguing.”

- Virtual Banking

‘Virtual Banking’ is the definitive guide to “Innovation and Partnering”, as it elucidates the truth behind the colossal migration of consumers from the traditional banks to the futuristic digital payments.A former head of financial innovations for PayPal, Dan Schatt in this book has articulated that fast-changing regulatory reforms and the cloud computing revolution will result in the extinction of the “Old Banking Ecosystem”.

‘Virtual Banking’ is the definitive guide to “Innovation and Partnering”, as it elucidates the truth behind the colossal migration of consumers from the traditional banks to the futuristic digital payments.A former head of financial innovations for PayPal, Dan Schatt in this book has articulated that fast-changing regulatory reforms and the cloud computing revolution will result in the extinction of the “Old Banking Ecosystem”.

He further suggests the incumbent banks to embrace electronic payments, mobile commerce, and Virtual banking so that they can compete in the modern era of FinTech. Dan Schatt has also elaborated on the implementation of steps the banks need to take which will allow them to survive.

- The End of Banking

Two authors under the pseudonym of Jonathan McMillan, both of them experienced in the world of economics and finance, have drafted a futuristic proposal of “Functional Financial Ecosystem” without any need of banking.Written in three parts, the first part describes the traditional banking system, defines the dynamics involved in the old banking system and how they have been working for the last hundred years.

Two authors under the pseudonym of Jonathan McMillan, both of them experienced in the world of economics and finance, have drafted a futuristic proposal of “Functional Financial Ecosystem” without any need of banking.Written in three parts, the first part describes the traditional banking system, defines the dynamics involved in the old banking system and how they have been working for the last hundred years.

The second part highlights the financial crisis during 2007-2008, where the authors provide an explanation as to why the old banking system will become extinct in coming years.

The third and final part is their proposal and an answer to the problem statement, where they have suggested FinTech, and the digital revolution as the ultimate solution. Readers must read the comprehensive proposal to get an idea of the visionary plan.

[Rich_Web_Video id=”3″]

This thought-provoking, bold, and visionary books, strongly recommended by the FinTech Gurus and written by the top best-sellers, are a must-read for any financial planner, investor, FinTech enthusiast, entrepreneur or a start-up businessman. These books keep you on your toes and are a wonderful guide about the world of FinTech and on the technological revolution happening around you. You sure shot will get stuck to them and will leave only to read the next one. Happy Exploring!

References: