Open Banking: End of Card Payments?

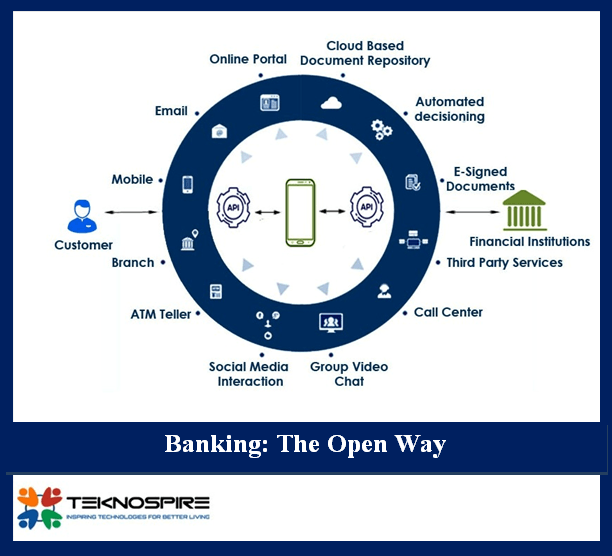

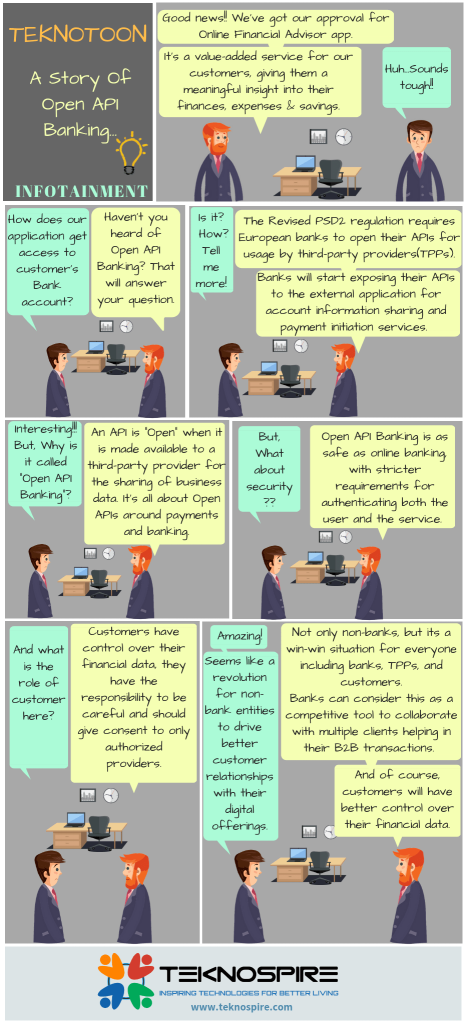

Any new technology or innovation always opens up the debate about the relevance of such models in the first place. When it comes to the Open Banking APIs (Application Programming Interfaces), the newest offering of FinTech, there are ongoing discussions on how it can bring about a revolutionary banking experience which is beneficial to the end users. The basic idea behind all these innovations remain to offer a better experience to consumers and leverage the choice of integrated systems that are widely available today. However, one of the most intriguing questions around the Open Banking model is about the potential it holds to change the payment ecosystem entirely. How Open Banking works? Taking one of its many applications, to provide assistance to you, so that you get the best of the deals available and can manage your finances efficiently, Open Banking will enable companies to give more accurate personal financial guidance, tailored to your particular circumstances and delivered securely and confidentially. To provide tailored advice, companies need to know how you use your account. At the moment, to get personal financial guidance, you have to hand over your confidential banking information to price comparison websites. Open Banking will use APIs (Application Programming Interfaces) to share customer information securely. Companies will be able to use open banking APIs to see your transaction information to tell you what you might save when considering the current account best suited to you. Or if you run a small business you could find the best deals for your business accounts and loans. No in-betweens, no interruptions, just pure and simple direct customer-to-service relations. Open Banking: End of Card Payments in Future? That’s certainly a possibility! Fundamentally, Open Banking is a concept that is all about the free flow of data. It allows third-party service providers to access financial information of the customers securely (with their consent) and in real time. An excellent example of this could be the banking payment mechanism which requires each transaction to be done manually using the payment cards. However, in an Open Banking platform, the API/app could download consumers’ transaction data directly from their accounts to process payments thus enabling cardless transactions. Although the concept is still in its nascent stage and will take some time to shape up, it will allow the third party organizations to initiate payments between the bank accounts of customers. What will probably happen, as a result, is this: Banks will no longer be required for processing the transactions/ card payments. An authorized third-party organization will be able to make payments on behalf of its customers. Customers won’t have to wait in long queues to make purchases using physical cards at stores. They will be able to easily make payments using digital wallets on their SmartPhones or Smart watches using emerging technologies such as Samsung Pay, Apple Pay, etc. Can Open Banking Change The Entire Payment Ecosystem? To be able to understand this significant shift towards cardless payments powered by Open Banking, it is important to have clarity on the working of the payment cards first. The payment card, essentially, is a token backed with a unique PIN or customer’s signature as authentication, which helps in identifying both the payer and the source to process any payment. Enter Open Banking into the picture! Open Banking replaces the payment card with the actual bank details of the customer without requiring any physical validation. By ensuring a robust authentication system in place (such as phone verification), the model can be easily used to process transactions directly. There are several benefits of saying ‘Bye-Bye’ to the cards and using Open Banking APIs to process payments. Benefits of Using Open Banking APIs for Transactions Over Cards a. Cost Saving This is perhaps one of the primary benefits of using Open Banking APIs to process payments instead of using cards. The open banking model is such that it requires no physical token leading to cost savings for card processors and savings on the infrastructure cost for managing expired/fraudulent cards. b. Ease of Setting Up The ease in setting up Open Banking products as compared to the card payment mode is another reason that makes the possibility of this phenomenal shift stronger. The open banking services are designed thoughtfully to offer solutions collaboratively with payment transfers such as allowing easy linking of the credit cards or bank details of the end-users. c. Convenience Convenience and ease of doing transactions is another attraction of the Open Banking model as a whole. Furthermore, storing bank details of customers is much easier as compared to the cumbersome credit card data, considering security & compliance as essential factors while making payment transactions. Instant purchase history, remote deactivation, and biometrics enabled virtual card provisioning are just a few of the features of cardless payments worth mentioning. Open APIs just make it easier for bank customers to transfer their bank accounts, manage payments, and perform transactions through third parties: both banks and non-banks. The concept creates new opportunities for Service Aggregators to offer better customer service from multiple service providers on a single platform. Does Open Banking Model Translate To the Cardless Payments? If you are still wondering about the Pros of moving to Cardless Payments, here is a list of some of the pros of this new way to pay for your everyday purchases using Open Banking API’s: Convenient as you don’t need your card for making payments and can do transactions without keying in a PIN or signing a receipt. Lessens the threat of hacking where the card might be scanned for stealing valuable information. Cardless payment means no reading of magnetic data strip. The verification token (OTP) is for single use only, making it perfectly safe for ‘Use and Forget’. Convenient and quick payments, which mean no hassle of queues and lining up. Cost and time-efficient without any worrying about remembering multiple cards and account details. Taking Stock of Future Possibilities As rightly said by Kristin Moyer, Vice President of Research and Distinguished Analyst at Gartner and I quote, “Open