Bank – FinTech Merger Importance and repercussions

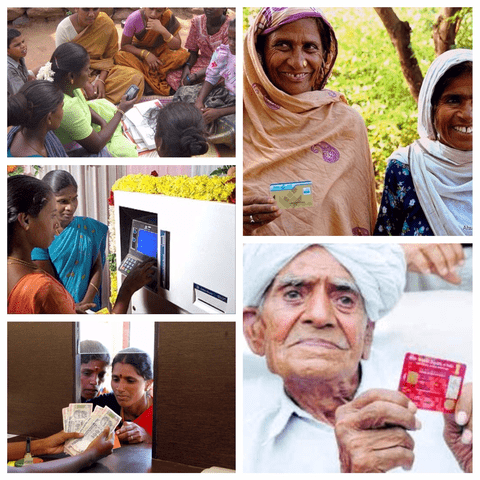

The financial services industry has entered 2018 with a focus on digitizing services to better meet customers’ needs. But do the banks understand that previously inefficient, paper-based processes and messy ‘not so friendly’ user interfaces are no longer going to be good enough in today’s technologically advanced environment? Banks are needed to connect digitally to succeed. With FinTech continuing to gain momentum, it’s just a matter of time, to see them fully integrated into business-as-usual banking. One of the world’s largest Deutsche bank calls for “a shift in mindset from one of competition to collaboration,” arguing that traditional banking providers and new innovators must work together in order to revolutionize the payments market and the wider financial sector for the benefit of all. They said it and I quote: “For both parties, a partnership should liberate them to focus on their core competencies and contribute these areas of expertise to the innovation process.” Fintech, no doubt, is the talk of the day amongst investors, financial service providers, entrepreneurs, and even big corporate houses. The phenomenal potential of creating innovative services and business model makes it disruptive in nature. Realizing the immense potential of the technology, “Banks” are looking to integrate with FinTech solutions. In short Bank+FinTech merger is next on the cards in the coming years. Welcome to the Era of FinTech. FinTech Nudged All FinTech, the technological innovation in the financial arena, registered its birth as a back-end activity, and today is nudging everything across the globe. It has transformed, almost everything, in such a way that you are about to witness the impact of the “fourth industrial revolution”. More than anything, it has created its own “FinTech Ecosystem” by embracing the following: Digital Payments Remittances Insurance Lending Financial and Wealth Management Retail Banking FinTech has impressed the Banking Sector and its customers, which is why the transformation in banking has touched a new height. The “2016 World Retail Banking Report” states that almost two-thirds of the retail banking customers across the world use FinTech products or services like cards & payments, loans, Investments, financial advice and mortgages. This is because of the UX standards they offer to their customers. 81% of the customers feel that FinTech offers faster services and extends a great experience. In addition, FinTech firms are fast catching up bank’s “niche parameter”- TRUST. The percent of customers who have complete or partial trust in FinTech firms is as high as 87.9% across the globe. FinTech-Globally Embraced Global acceptance of FinTech is evident from a recent comparative study by EY (formerly Ernst and Young) which reported FinTech adoption between 2015 and 2017 has increased across various countries like- Australia, France, Germany, China, and India. The figures indicate adoption of past (2015), present (2017), and future (as responded in the survey). The adoption of FinTech in these countries has climbed exponentially: Australia- From 13% in 2015 to 37% in 2017 France- From 27% in 2015 to 40% in 2017 Germany- From 12% in 2015 to 35% in 2017 China – From 69% in 2015 to 77% in 2017 India – From 52% in 2015 to 80% in 2017 ‘Banking with FinTech’ attraction Like any other sector, Banks have started reacting to FinTech, and since 2015, FinTech Banks have started emerging. Banks and Financial inclusions have initiated startup programs to constitute FinTech companies. Across the globe, 43% banks created such startups. Another 20% set up VCs to fund FinTechs. There are obvious reasons behind banks being forced to or influenced by FinTechs. EY FinTech Adoption Index 2017 released in June 2017 indicates that the appetite of digitally active consumers has risen considerably, from just one in seven digitally active consumers in 2015 to one in three in 2017. The report also shows that in 2017, there are 84% consumers aware of the fintech facilities in comparison to just 62% in 2015. The same reports show that the fintech adoption rate is expected to reach an average of 52% globally from the current rate of 33% in 2017. Such growth in numbers could soon blur the boundaries between different financial services, laying down new standards for the industry during the process. To stay ahead of the curve, financial firms would benefit from the technical assistance from the fintech startups. Why FinTech Lures Banks Unlike traditional banking, FinTech reduces structural cost and operational deficiencies. The communication between branches or P2P transactions happens in real-time environments. Real-time updates, proactive alerts and agile innovation are an integral part of an enhanced customer experience. When right technology is used, it can reduce the need for manpower and even the “Brick and Mortar” locations. FinTech provides simplicity of design and power of contextuality that consumers are increasingly expecting. Another customer expectation of ‘externally simple yet internally efficient’ service platform is forcing the banks to rethink their policy of ‘working alone in stumbling mode’ or ‘working and staying ‘in the game’ powerful mode. It also enhances regulatory compliance and better service to customers. Fintech firms like Teknospire are delivering convenient and affordable services by providing sustainable solutions for digitization of financial ecosystem to market segments (unserved and underserved) by taking care of their need for microloans and grants to the last mile, that till today were thought as unprofitable zone for banking organizations. User friendly, data focused seamless technology is bringing more personalized offerings. With the security aspect, well taken care of, with biometric advances, the virtual reality solutions are helping customers interact with the banks in innovative ways which were unheard of, with traditional banking. The fast and efficient products and services of FinTech have attracted Banks to offer P2B services. This is evident from the fact that many have started offering traditional in-bank services on mobile devices as well. This has helped them offer high levels of access to consumer, and hence, a better usability and User Experience (UX) standards. Advantages of the Alliance betweenFinTech and Banks With FinTech and Bank partnership, the ultimate