Current Fintech Trends In Emerging Markets

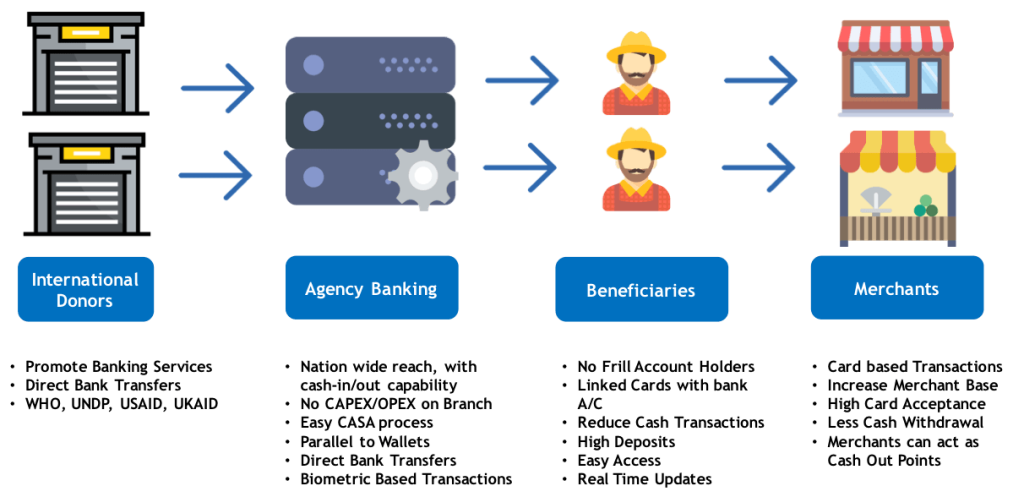

Fintech Transaction Fintech is best described as financial services initially being provided by banks now provided with the help of technology by banks and other tech firms. For my Non-Tech readers, I would best describe Fintech as the marriage of finance with technology. Fintech is the buzz word now especially in the developing countries where banking is still a luxury for a majority of the population and currency is “the” main means of trade. Now compared to the west the emerging markets are potentially huge markets for the fintech firms. By emerging markets, I mean the BRIC countries (Brazil, Russia, China, India), South Korea, Mexico, Indonesia, Turkey, Saudi Arabia and Iran, Kenya, Zimbabwe. China and India are the top emerging countries contributing to the fintech boom mainly owing to a growing e-commerce sector. Surprisingly China has overtaken the west in fintech adoption levels. Zimbabwe, Nigeria and Kenya lead the African team. Indian Fintech CompaniesHere I would be taking on the Indian Fintech market, India being an ideal EC** market for highlighting. What is making the fintech firms to click and stay around here ? It is primarily their disruptive technology. Companies like Paytm, Oxigenwallets, Mobiqwik provide fintech applications easily accessible on smartphones anytime anywhere. Also, for the EC’S population that has easy access to a smart-phone than a bank, this comes as a boon. Present trends such as UPI indicate that Indian fintech firms are busy taping payment solutions, customer engagements and process involvement segments. Fintech Trends 2017 According to KPMG and NASSCOM study, the current monetary value of the Indian fintech sector is $33 billion and would annually shoot up by 22% to $73 billion levels by 2020. 2017 would witness Indian fintech eyeing areas of wealth management, lending and insurance to further scale up their activities. Apart from expansion the upcoming trends that Indian Fintech sector would be witnessing would be :- Micropayments :- With the advent of demonetization the face of digital payments has changed. Micropayments, various applications have come to the fray making the ecosystem better and speedier. 2017 will see a lot of action in this segment. It would take some out of the box thinking to solve the pain areas if the existing fintech firms or start-ups wish to survive in this segment. BlockChain Adoption :- The technology adopted for “Cryptocurrency” or the digital currency is going to witness a larger adoption in India mainly due to its wider acceptance, security and transparency features. Banks in India especially the RBI are looking forward to adopting this technology to reduce cheque frauds. Adopting blockchain would do a massive turnaround in simplifying operations, risk and fraud reduction, lowering settlement time and capital improvement. Providing Loan Accessibility :- In EC’s **like India almost 3/4th of the population especially those in the rural areas do not have any access to the credit facility. In 2017 we could witness Fintech making an entry in this segment, this would make loan accessible to those who cannot access it. Fintech for Social Causes:- Fintech startups who wish to solve social-economic issues through profit would see a spurt this year. These start-ups would use technology that caters to large number of people and would widespread their business to solve these issues and bring in financial inclusion. Regulatory Technology:- RegTech firms would make a landing this year. These firms aim at making compliance friendly to businesses and entry by providing tools that automate compliance task, improve identity management, reduce fraud risks. Though still in its development stage in India it can help other firms to concentrate on their core competencies than spending time on regulatory requirements. Teknospire is an example of a fintech company in sync with the trends. Our Fintech solutions are :- Provides accessibility to loan payments and disbursements. Supports Micropayments in form of remittances, utility payments, online purchases, merchant payments, voucher payments and redemption. Contribute to solving social issues through lean banking. Having discussed on the current fintech trends and how Teknospire is in sync with the trend, we would be highlighting the “Fintech Technologies used in 2017 “in our upcoming blog. References: MARTIN CURRIE INVESTMENT MANAGEMENT The 5 big fintech trends in emerging markets Fintech Forecasts for the Emerging Markets #5 Fintech Trends That You May Want To Watch Out For in 2017 As India’s Fintech Reaches Inflection Point, Is There a Need to Regulate? RISE OF FINTECH COMPANIES IN INDIA – THE NEW TREND IN DISRUPTION FOR INDIAN RETAIL BANKING SECTOR Financial technology – Wikipedia Emerging markets – Wikipedia Emerging Markets: India and the Pyramid of Opportunity in Fintech FinTech Outlook for 2017: Report Discussing Trends, Opportunities and Challenges Picture Courtesy Google **EC Emerging Countries