Corporate Social Responsibility and The Impact of FinTech

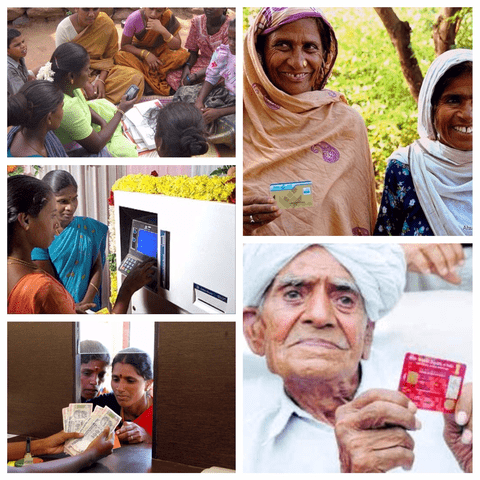

Creating a strong business and building a better world are not conflicting goals – they are both essential ingredients for long-term success”. – William Clay Ford Jr., Executive Chairman, Ford Motor Company. With corporations becoming more responsible towards the society, this concept has evolved into what we today know as Corporate Social Responsibility (CSR). CSR has been increasingly recognized as a means for businesses to serve communities in the best possible manner. It has also made the consumers feel a sense of attachment with the business entity. What is Corporate Social Responsibility? Corporate Social Responsibility can be understood as a business model that is aimed at Corporates to become socially responsible and answerable to its stakeholders and to the public at large. Corporate Social Responsibility, on one hand, has helped businesses with better interaction with consumers and on the other hand, has had stakeholders develop loyalty towards the business. It also has enhanced overall reputation – a powerful statement of what they stand for, in an often cynical business world. Jason Potts, a senior associate with the International Institute for Sustainable Development (IISD), who is taking care of sustainable markets and responsible trade initiative, says: “CSR is fundamentally about ensuring that companies forward broader public objectives as an integral part of their daily activities and this can only be ensured with the appropriate communication channels with stakeholders.” “CSR policies need to be considered as a core and inseparable component of the overall service or product offering”, he further adds. Importance of CSR to Corporates Companies that display their concern towards various social causes are surely better off than those that don’t. CSR has the ability to change dynamics for any given corporate. For Klara Kozlov, head of corporate clients at the Charities Aid Foundation, “CSR allows businesses to demonstrate their values, engage their employees and communicate with the public about how they operate and the choices they make, to ensure a sustainable future. CSR helps pave the way for partnerships between businesses and civil society that are based on common goals and shared actions to deliver impact-driven outcomes.” Few of its benefits include: Public Image Social responsibility not only improves an entity’s public image but also helps it become a consumer-favorite in no time. Enhances Engagement of Employees Companies, which show their interest in improving the society’s well being, attract and retain hardworking as well as valuable employees. Not only this, those hired demonstrate better productivity and strive for better profit margins. Retention of Stakeholders Investment in Corporate Social Responsibility indicates a company’s strong ethics and high standards. Such outlay, in the eyes of investors, prove that the company does not solely care about profits but also has a sense of duty towards citizens. Such a display of sound business policies certainly attracts and retains investors. Reduction in Operational Costs The concept of CSR also helps a business reduce its operational costs to a great extent by opting for business practices that do not affect the public adversely. For instance, by option for green technologies and reducing emissions & waste, companies save a great deal of cost. It can be said that CSR has a dual positive effect on both, the consumers as well as the business. Problems Companies Face with CSR Corporate Social Responsibility has become a complex phenomenon with companies developing holistic policies to address the demands of the public. As such, there come several problems related to the execution of initiatives such as disbursal and tracking of funds, cost-benefit issues, etc. We try to highlight the major problems that companies, the world over, face with respect to CSR. Disbursement of Money Every company indulging in CSR has an exclusive monetary account through which the company disburses money for various causes. However, due to lack of digitization, such money is disbursed in the most haphazard manner, making it practically difficult to keep track of the amount. Accountability of Money: Once disbursed, there is hardly any check on how such grants are being deployed and utilized by those concerned. This makes it almost impossible for an entity to recognize the cost benefit of their contribution. Sans any digitization of money movement, amount once paid out is nowhere to be accounted for, indicating lack of answerability and utter pecuniary wastage. Sustainability of CSR activities: More often than not, the amount spent with huge fanfare falls short of giving estimated returns to the business over time due to lack of diligence and monitoring. Initiatives become difficult to sustain owing to a deficiency in digital regularization. Role of FinTech Companies in CSR Over time, FinTech companies have been recognized as an imperative element of business operations, especially with respect to CSR activities. FinTech companies or simply put, companies designing and developing technological and digital programs to aid financial or banking operations and services help businesses immensely in regulating the financial approach. Employing a FinTech company to CSR activities can contribute greatly to any business. Digital Payments Mobile wallets and app-regulated payment disbursal portals have made the transfer of money as smooth as ever. Corporate entities save on crucial time and money spent on such disbursal while opting for digital methods. Bridging the Gap: The core area of all CSR activity for a majority of companies are the rural and underdeveloped areas where financial exclusion is a major problem. However, FinTech companies are bridging the gap between the lender and borrower and even reaching people who do not own a bank account. They are further helping the customers by providing assistance before, during and after the financial transaction by extending the ecosystem of the banking system. Countries that have a majority of the population thriving in rural areas have finally had access to banking, thanks to the inception of FinTech. For instance, Bangladesh has about 70 % of people living in the rural areas where not even half of them own a bank account. To cover the deficiency, ‘bKash’, a FinTech initiative, allows such people to receive as well as send money through mobile phones. Crowdfunding: FinTech’s