Blogs

Treasury Management: Simplifying Conglomerate Multi-Entity Cash

For CFOs and Group CFOs leading large enterprises and conglomerates, the vast networks of entities, divisions, and global offices they manage involve huge capital. This complex business....

Read MoreHow does FinRecon’s Automation Slash Your Reconciliation Expenses?

For finance, accounts, and collections teams, the daily grind of reconciliation isn’t just about matching numbers – it’s a silent, draining expense. Are you ready to uncover....

Read MoreEscrow Management for Real Estate market – Rewritten for the Real World

If you’ve ever been part of a large real estate transaction, either on the banking side or the builder’s, you know it’s rarely as smooth as the....

Read MoreBeyond the Pixels: A Chat with Pramod Kumar

Hi! We’re here again! Today, as we pull back the curtain, you will unveil one of Teknospire’s absolute rockstars, the kind of wizard who turns complex fintech....

Read MoreModernising Treasury Management for Enhanced Liquidity Performance

Good cash flow is the key to any business’s success. Managing money the old way, with many separate systems and manual work, can be slow and complicated.....

Read MoreUnfolding The Hidden Costs of Manual Reconciliation

Manual reconciliation means countless hours, piles of spreadsheets, matching multiple transactions and chasing down discrepancies. Beneath all these lies a list of hidden costs that directly impact....

Read MoreBeyond the Pixels: A Chat with Bhavani Madhusudhanan

What if Teknospire is a bustling kitchen where innovative fintech solutions are cooked up, and Bhavani Madhusudhanan is one of our star chefs? She knows the right....

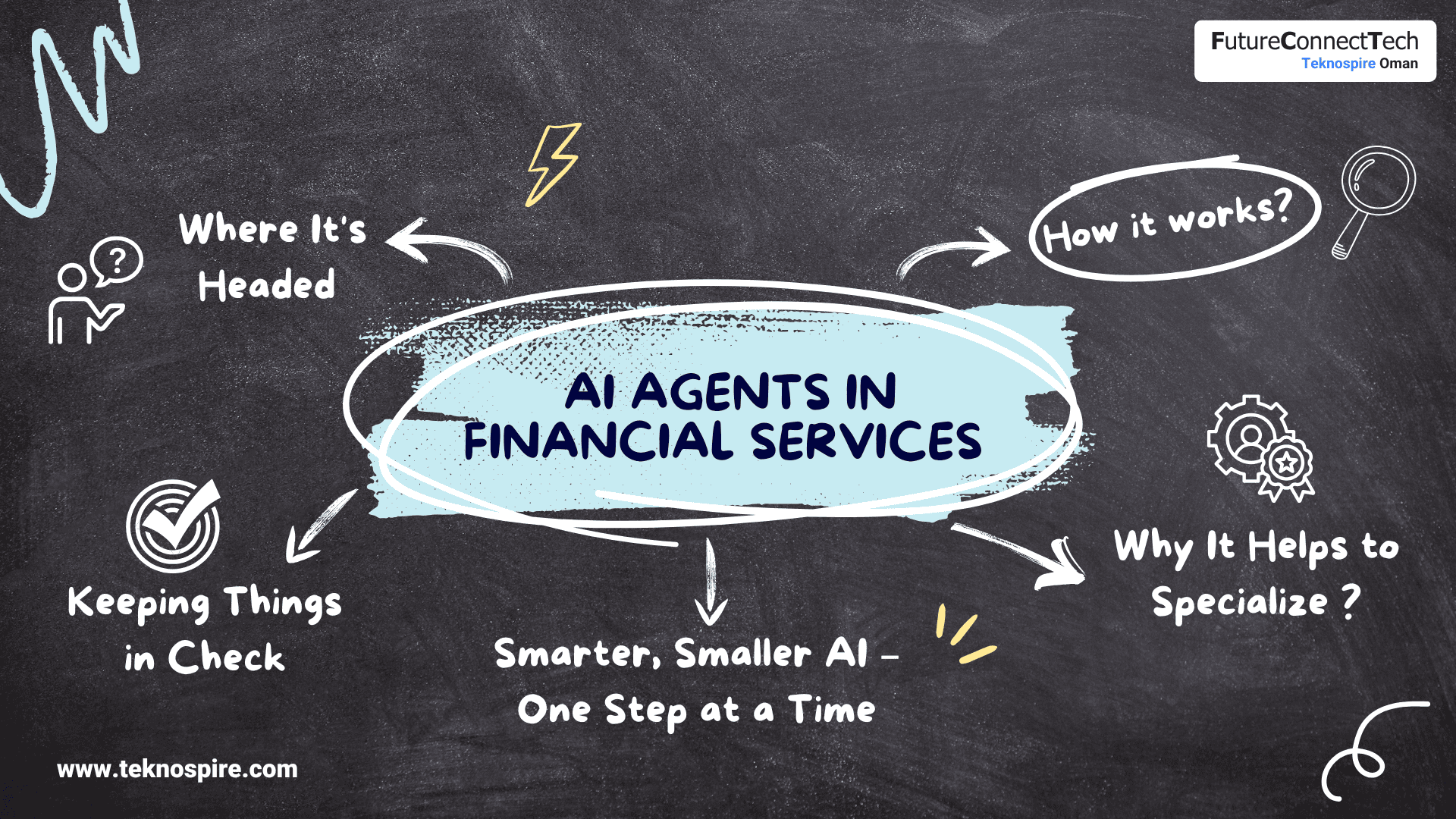

Read MoreThe Rise of Specialized AI Agents in Financial Services

AI in financial services is no longer just a buzzword. It’s quietly working behind the scenes, not in the form of big, futuristic systems, but as focused,....

Read MoreAccelerate Financial Close with Automated Account Reconciliation

Tik-tok round the clock! The month-end. The quarter-end. The year-end. The clock hands keep ticking, and the calendar pages keep turning. These periods often feel like a....

Read MoreSingle Account Treasury Management System Empowering Conglomerates

Is your treasury team having trouble managing your enterprise’s finances and constantly checking countless individual bank accounts? The sheer volume of transactions, disparate balances, and endless reconciliations....

Read MoreThe Evolving Landscape of Treasury/Cash Management System

Effective Treasury management Software is crucial for businesses of all sizes, helping them optimize liquidity, reduce financial risks, and streamline cash flow operations. With increasing globalization, regulatory....

Read MoreAchieve Financial Control Using Treasury and Reconciliation Automation

Did you know that manual reconciliation can consume up to 40% of a finance team’s time? In today’s fast-paced global economy, large conglomerates face the daunting task....

Read MoreWhy Banks Offer Treasury Management Systems

As businesses grow and operate across multiple markets, they require real-time visibility, greater control, and optimized liquidity management. Financial institutions (FIs) have an opportunity to enhance their....

Read MoreWhy does a business need Single Account Treasury Management?

For large conglomerates operating across multiple regions and business units, managing multiple bank accounts across different banks is a persistent challenge. CFOs and treasury teams struggle with....

Read MoreAgentic Payments: The Future of Smart Transactions

Imagine a future where AI handles your payments automatically with no manual input, no delays, and no human error. That’s exactly what agentic payments are all about.....

Read MoreTeknospire: Driving Innovation in the Fintech Landscape

India-based fintech Teknospire is a leading provider of innovative products and solutions. With technological advancement, it continues to serve multiple African and Asian countries. Now, it is....

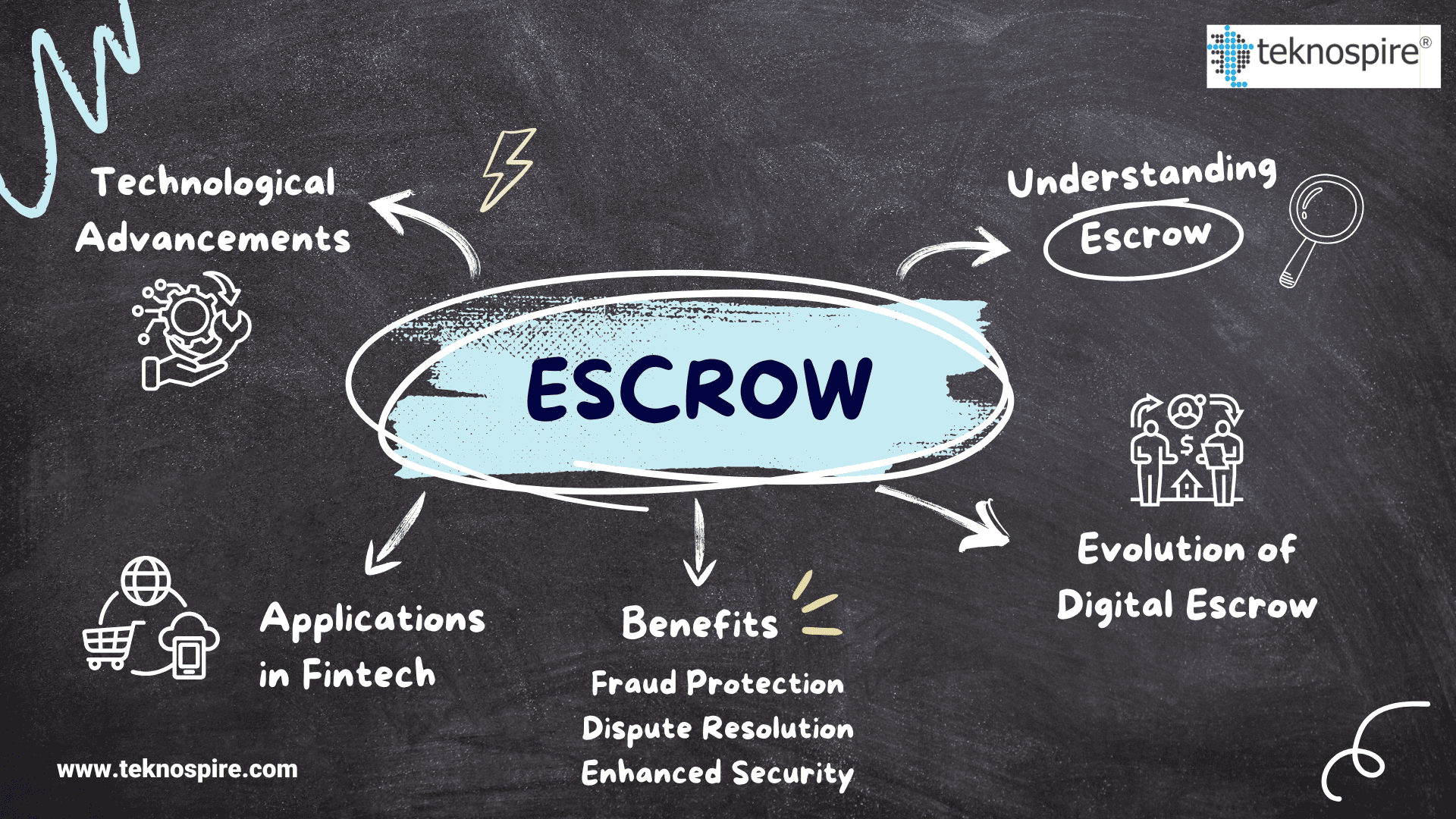

Read MoreDigital Escrow: Revolutionizing Trust and Security in Fintech Transactions

Digital Escrow services play a pivotal role in modern financial transactions, offering a secure and trustworthy method for managing payments between parties. In the fintech sector, digital....

Read More5 Steps to Streamline Inventory Reconciliation with FinRecon

Maintaining accurate inventory records is crucial for the success of any business. It often happens that the inventory counts in your records don’t align with the actual....

Read MoreHow to Streamline Bill Payments with AI?

With the rapid evolution of technology, every business and financial institution demands operational efficiency to streamline complex payment processes, handle volumes of transactional data and comply with....

Read MoreEmbedded Payments: A Seamless Future for Digital Transactions

Embedded payment solutions are transforming digital platforms, allowing users to make secure, instant payments without ever leaving the platform they’re using. This shift represents a major advancement....

Read MoreHow does Reconciliation Platform Revolutionize & Reshape Industries?

Are you familiar with automating your account reconciliation processes? Yes, you heard that right. Organizations nowadays deal with huge volumes of data, which exist in various forms....

Read MoreAutomated Reconciliation for Enhanced Accuracy and Efficiency

Are you spending countless hours reconciling financial data across spreadsheets and files? The struggle with inaccurate financial records is tedious and drains costs and resources. All of....

Read MoreWhy Manual Reconciliation Is Outdated: Embrace AI-Driven Automation with FinRecon

Manual reconciliation involves comparing and verifying transactions or relevant financial data, such as account balances manually without any intervention of automation or technology. This process requires additional....

Read MoreTransform Financial Reconciliation with FinRecon

Financial reconciliation is the process of comparing and matching transactions/financial records to ensure they align with supporting documentation. The purpose behind doing this is to ensure the....

Read MoreFinternet: Revolutionizing the Future of Finance

In the rapidly evolving world of financial technology, a new concept is emerging that promises to reshape how we interact with money and assets. Finternet – a....

Read MoreFuture of Finance – Embracing Digital Transformation

Today, with just a few taps, funds can be transferred, bills can be paid, and purchases can be made. All without needing to touch cash. As technology....

Read MoreHow to Streamline your Finances with FinRecon

Numerous offices and departments spend hours performing reconciliation work, looking through entries, and comparing them with bills and receipts. The task becomes tedious for many, resulting in....

Read MoreFinancial Inclusion and Union Budget 2020

Financial inclusion is increasingly being recognized as a key driver of economic growth and poverty alleviation across the globe. Studies have found that access to formal finance....

Read MoreMobile Wallets in India 2020

Mobile Wallets has grown rapidly in India. As per a BI Mobile Payments report, in-store mobile payments would grow to $503 billion by 2020. As per another....

Read MoreDigital Banking and its Allies for 2020

USA Number of digital banking users in the United States from 2014 to 2019 161.6 million a twenty percent increase from 2014. Source – Statista Great Britain....

Read MoreTop 5 Fintech Post 2019

A big year for Fintech – or should I say Fintech-led disruption? Experts predicted Fintech to scale in 2019, and they weren’t wrong – innovation-led banking, bypassing....

Read MoreFour KPI’s to Measure ROI of a Digital Bank in 2020?

While, as a technology provider firm we always urge our clients’ Banks and FI’s to adopt “Digital Channels,” we also stress on How to evaluate the ROI....

Read MoreIs Neo Banking all about UI/UX?

Experience! How do you craft a digital experience for your consumers? BY providing them a robust, stable, highly efficient digital platform, but have you thought that 80%....

Read MoreTurkey Cashless Society by 2023 – Mobile Wallets are the key!

Have you ever tried Turkish tea? For a tea-addict like me, it was incredible! And thanks to these fantastic tea flavors that I got to know about....

Read MoreNeo Banks In India

Just a few days back we got an interesting query on our website chat – Which new technologies already present in foreign countries can be adopted for....

Read MoreThe evolution of mobile wallets and digital payments in Jordan

Digital is just not a word anymore;its your life. Part and parcel of humans, economy, and countries. Each country is trying to regulate, innovate, implement digital solutions,....

Read MoreHow to offer a best-in-class Mobile Wallet experience for MENA?

The Middle East and North Africa are witnessing a change in consumer preferences, evolving Fintech start-ups, and supporting regulation are testing banks and FI’s digital capabilities. The....

Read MoreDigital Wallets in Israel – Use Cases, Consumers, and Economy

In the year 2006, when I was in Pune, many Israelis were staying within our locality. Apart from the country name and a possibility of locating it....

Read MoreMobile Money wallets in UAE

Mastercard, in their recent report “The Cashless Journey,” stated that UAE economy is among the most rapidly growing as a cashless based society. VISA another leader in....

Read MoreNeo Bank – Use Cases, Impact and how it is challenging the incumbents

The post first appeared on linkedin. To get more such insights, please connect with me here. I often get this question – How different is a Neo Bank from a....

Read MoreWhy Should Banks Go Digital?

First, it was customers pushing banks to adapt to the digital wave, and now non-bank enterprises growing as competitors are pushing traditional banks to become digital enterprises.....

Read MoreSahamati and Data say – I Do! A match made on earth for fintech, banks, and customers

Data the new Oil has been under scrutiny these days. When Microsoft bought LinkedIn or when Facebook acquired Whatsapp, the speculation was that they were eyeing the....

Read MoreNeo Banking – An exclusive Digital Bank

Image Credits – cryptohead.io The post first appeared on linkedin. To get more such insights, please connect with me here. Could a bank without the physical walls exist? If....

Read MoreDIFFERENT WAYS TO BANKING – DIGITAL, ONLINE, INTERNET, MOBILE BANKING, NEO, E-BANKING

Editor’s Note : This post was originally published in [January, 2019] and has been updated for freshness, accuracy and comprehensiveness. What is Online Banking Accessing Banking services....

Read MoreWhat is Digital Banking and How Digital Banking Works?

I wonder if “Right to go digital” should be included as the seventh fundamental right in India. What do you say? Be it a shop, a salon,or....

Read MoreFinancial literacy – The fourth pillar of Financial Inclusion

The post first appeared on linkedin. To get more such insights, please connect with me here. While I was privileged to go to school, get educated, watch tv, buy....

Read MoreRegulation need to strike a balance to enable Financial Inclusion

The post first appeared on linkedin. To get more such insights, please connect with me here. This is the third part of my Financial Inclusion series, in case you....

Read MoreWomen are the “Changemakers” to Financial Inclusion

The post first appeared on Linkedin. To get more such insights, please connect with me here. My last post on LinkedIn spoke about “extra push” from government, brands, banks,....

Read MoreKPIs to measure ROI of a digital bank

The post first appeared on FINTECH FUTURES. To get more such insights, please connect with me here. An Avaya survey in India a couple of years ago....

Read MoreFinancial Inclusion needs an extra push!

The post first appeared on linkedin. To get more such insights, please connect with me here. What is the longest distance you traveled to avail a service?....

Read More